A bull trap occurs when longs take on a position when a stock is taking off, only to have the stock reverse and shoot lower. [1] This counter move produces a trap and often leads to sharp sell-offs. If you haven’t encountered a bull trap, then you don’t know about pain. After trading for 19 years, getting caught in a trap is one of the worst feelings in the world.

Emotions Behind the Pattern

The reason bull traps are tough for new investors is the emotional aspect of the trade. Think about it for a second. For most new traders you will enter your position with some level of apprehension because you are unsure about taking the position in the first place. Then something miraculous starts to happen. The stock you were just worried about begins to rally and not just rally but does so with price and volume.

In the flash of an eye, all of the worries wash away from you and your confidence begins to build. Then just as quickly as you feel you are in control of the situation, you wake up to a morning gap down or if you are day trading, the stock just plummets on high volume.

Freeze Phase

At this point, you have just entered what I like to call the freeze phase. This is where you know you should sell, but are unable to because you believe the stock will come back.

I think you know what happens at this point.

What You Will Get in This Article

Well, throughout this article, I will provide one simple strategy to protect yourself from being caught in the trap – accepting the risks.

Bull Trap Setup

Bull traps are really easy to identify on the chart.

You first want to locate a price range that is broken to the upside. As soon as the stock breaks this resistance it rolls over and crashes back below the breakout point with volume.

Bull Trap Charting Example

Below is an example of a bull trap that takes place in the stock Honeywell (HON) over a two day period. HON broke out on the close of 9/6, only to gap down and break the low of the preceding range on 9/7. This sharp countermove produces the perfect bull trap.

Bull Trap

Strategy #1 – Don’t Panic

Riding High

You went to bed and your long position was safe and sound. You could be up anywhere from 10% to 30%. Remember, you have likely enjoyed a positive position in the stock for some time.

Something Bad Happens

So, you go from double digits to a losing position in a matter of seconds.

The first thing you want to do is stay calm.

Immediately look to the left of the chart to identify key support areas. This will give you some indication of how far the stock can go against you.

Accept the Risk

Now that you have your “worst-case” scenario, start to analyze your risk exposure. Are you at risk of losing a lot of your portfolio on the trade?

Have you tripped your stops on the trade?

If the answer to both of these questions is no, then you need to accept the risk and manage the trade. According to author Mark Douglas, in his book Trading in the Zone he states, “The best traders not only take the risk, they have also learned to accept and embrace that risk.” [2]

Let’s look at a real-world example from my own trading, where I did not accept the risk and therefore took an unnecessary loss.

Real-Life Example of You can Lose Money Panicking

I had my eye on Zynga (ZNGA) for quite a while and decided to go long. I took a long position at $3.28 and the stock immediately started to rally. Fast forward one day later and ZNGA hit an intraday high of $3.62 which was a gain of slightly over 10%. If you are not in control of your emotions, a quick 10% gain can cause a bit of an ego trip.

Now skip to day two of the trade and you will see that the stock not only gapped lower but went well below my entry point, all the way to a low of $2.85.

Emotions Get the Best of Me

From what I remember, I felt sick to my stomach on the morning of the gap down. It wasn’t just that I was in a losing position, but I also have the rule to avoid stocks right before their earnings.

I beat myself up the entire pre-market from 8 am to 9:30 am when ZNGA opened.

Do you want to know the end result of beating myself up for an hour and a half? I was in such a panic state, I sold out of the position at 9:31 am at $2.88 cents for an ~12% loss.

You thought this was bad. Well sit back and get your popcorn, the story gets worst. So, as expected ZNGA drifts lower over the next few weeks to make an ultimate low of $2.72. So, this would have meant I would have been down a total of 17% percent had I stayed in the position. Sounds bad, but being down 17% is not the end of the world.

Take a look at what happened next.

So you could be saying to yourself, well this trade worked out, but what if Zynga had tanked and you lose way more money.

I Didn’t Look to the Left for Support Levels

This is a fair point of view; however, back to what we discussed earlier in this article, had I looked back a few months I would have noticed the last swing low on ZNGA was $2.50. While this would have been a larger loss than me closing my position at $2.88, it just proves my point that I was not willing to accept the risk.

I had opened the position, placed a stop-loss order, but I wasn’t truly comfortable with the fact the market can at times go against you quite violently.

What Happens When You Don’t Panic

I would be re-missed if I just left you with a depressing article of how panicking cost me money. So, let me show you how I have matured in a short period of time to learn when I am “jammed up” and how to manage the trade effectively.

Do Not Set Huge Stops

Let’s first set the record straight, I am not suggesting that you should have huge stops of 30% or 40%. What I am saying is that once you have recognized you are in a trap (and no matter how good you are this will happen), instead of panicking think through the next level down where a bounce could begin to reverse the trap.

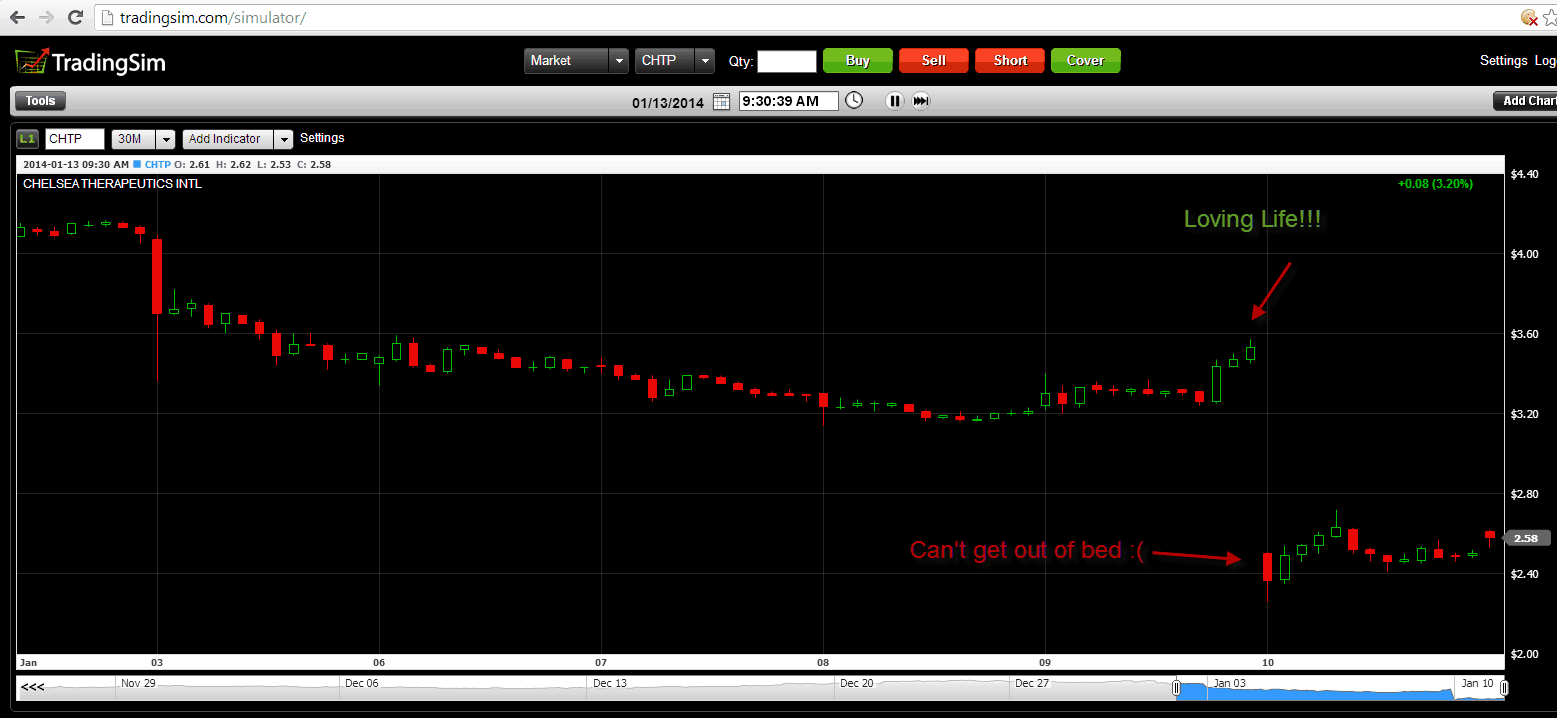

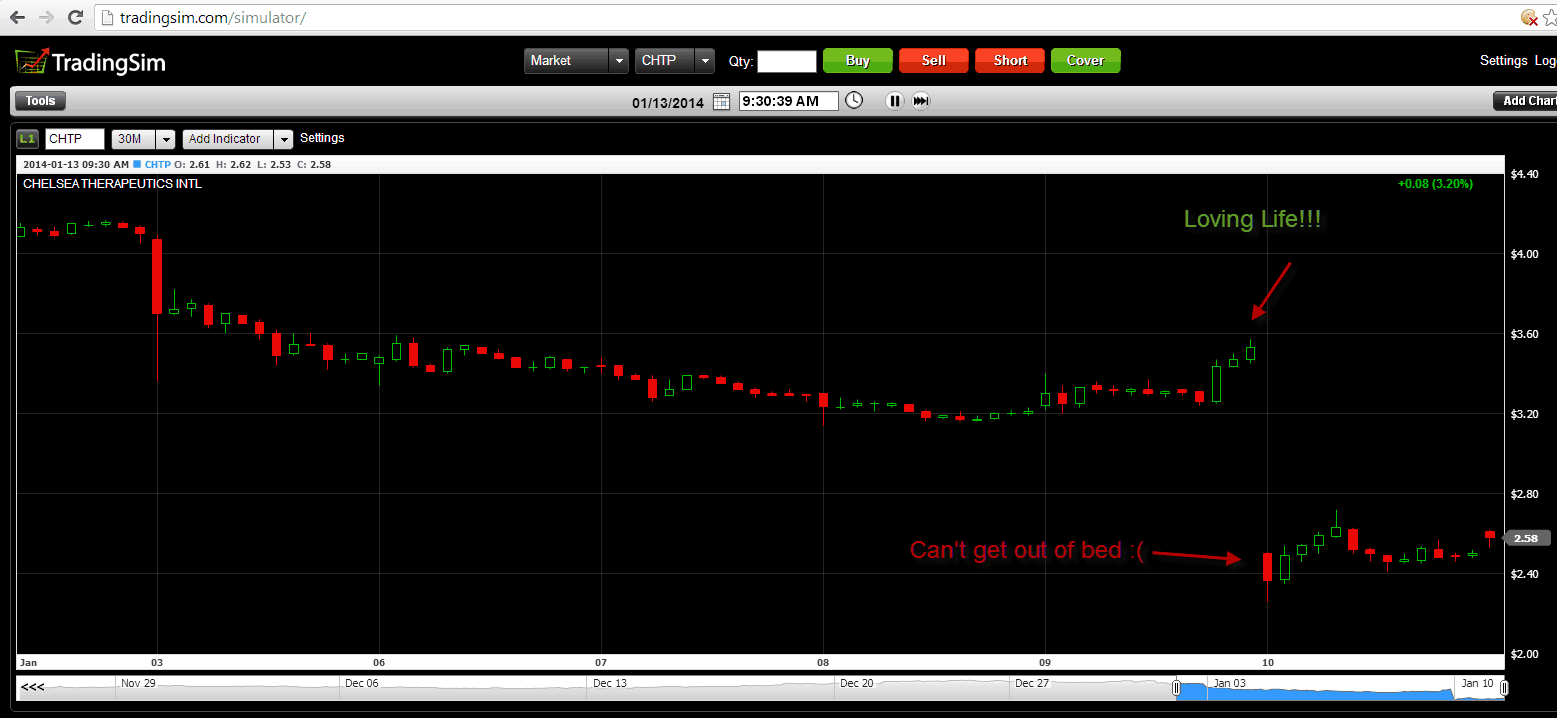

CHTP Trading Example

My next real-life example is of the biotechnology company Chelsea Therapeutics (CHTP). I bought the stock at $3.20. This was my first trade of the New Year, so you can only imagine the psychological importance. Not to mention I had just hit another peak in my trading account; you could say I was riding on a bit of a high.

I should have known that I was in for a rude awakening. Sure, enough the market delivered a nice piece of humble pie right on time.

CHTP like Zynga began moving immediately in my favor. By the close on the very next day, the stock finished the day at $3.57.

This represented a paper gain of 11.5%.

Caught in a Trap

I was planning on closing half of the position on a morning pop; however, the market had other plans. I remember sitting at my desk doing my pre-market scan of open positions and seeing a trade come through at $2.50.

I remember thinking, something must be wrong with my data feed. So, I went out to Google and typed in “CHTP quote” and again saw results of $2.50. Again, I figured there must be something up. so I went over to the official Nasdaq site. To my grim surprise, CHTP in fact was trading in the $2.50s. This represented a loss of over 20% and a ~30% swing down from the previous days’ closing price.

I felt utter defeat as I looked onto the screen. I couldn’t believe I was caught in yet another bear trap similar to Znyga, but also that my losses were far greater.

Phoenix Rises

But, then something started to happen. I said to myself, “You are in a losing trade and it’s really bad. If you close the trade out here you will get the immediate relief of exiting the position, but remember what happened with Zynga”. So instead of panicking, I looked at the chart to see the next support level down.

As I scanned back through the chart I noticed a swing low at $2.02 and another one at a $1.68. For me, this would have represented a potential loss of ~37% and 48% respectively. I sat at my desk and asked myself the very real question, “Are you prepared to lose this amount of money and more?”.

There were a number of thoughts that went through my mind as I pondered through the various outcomes. How did I let it get to this point? Why would I allow a stop so large on one position?

At the end of it all, I accepted the fact that the “market happened” and there is nothing I can do about it. All I can do at this point is to manage the risk. So, with that in mind, I placed a mental stop loss at $1.68 and I was going to let the market move in its desired direction.

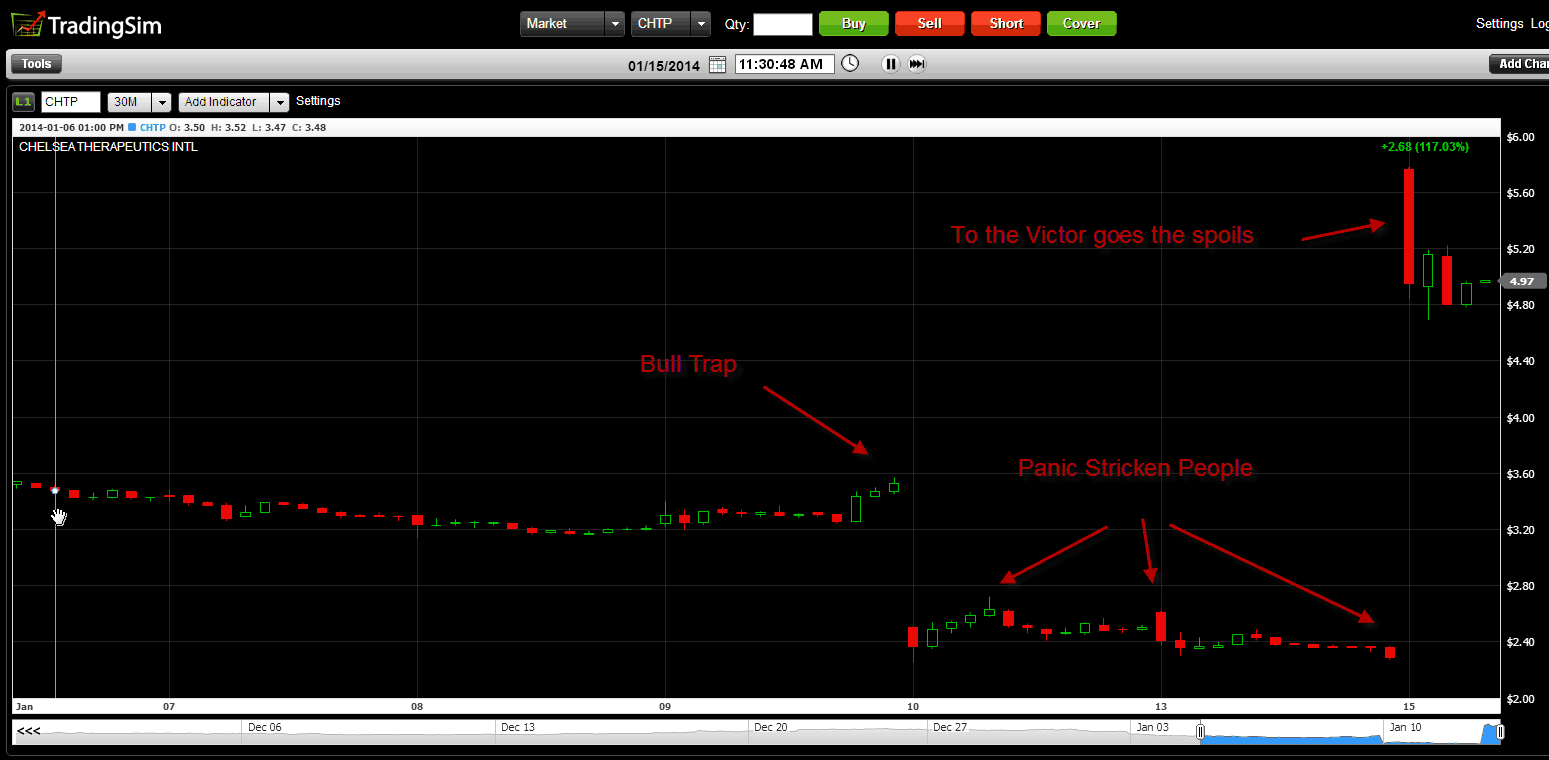

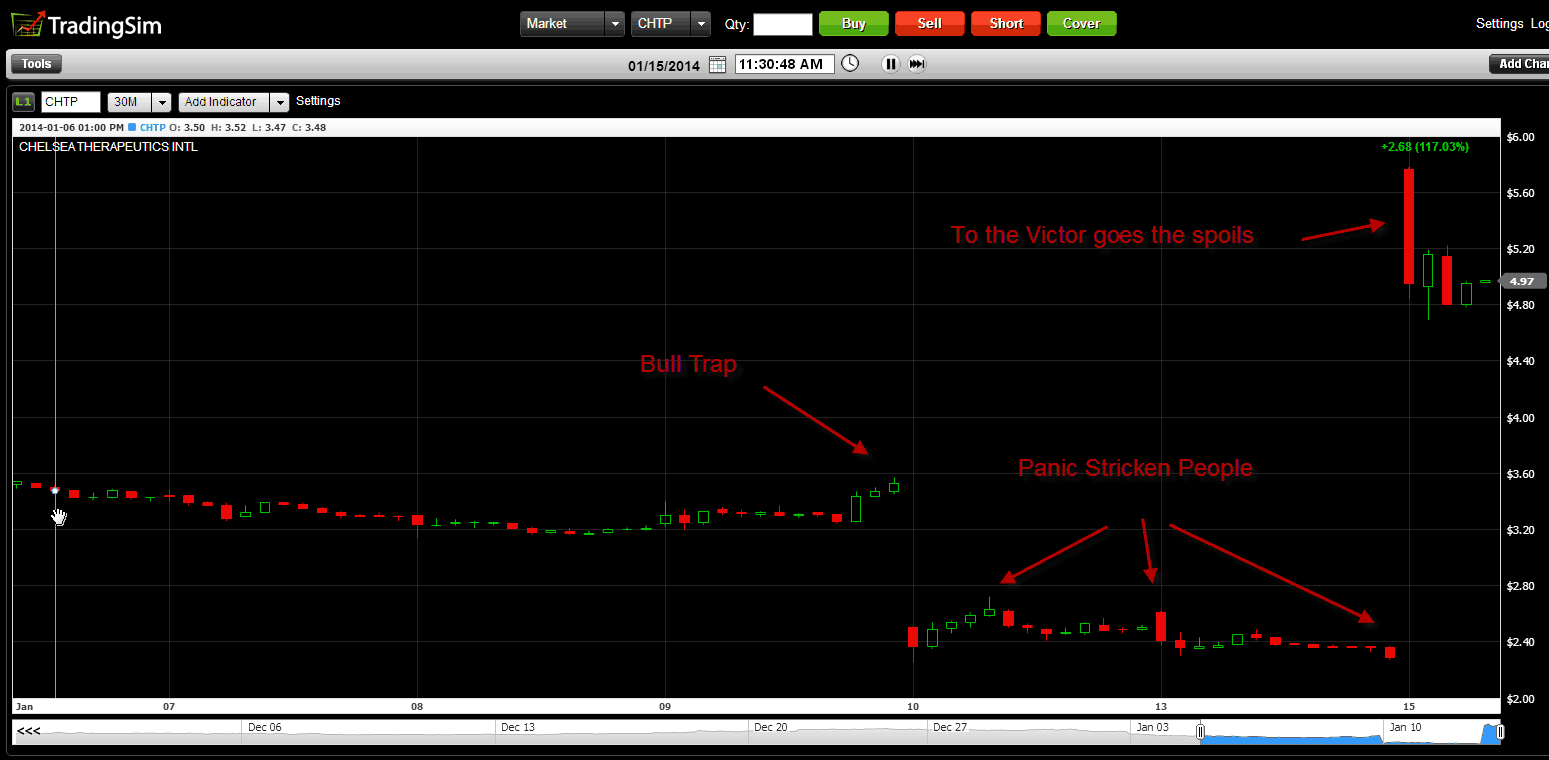

When I looked at the chart, it appeared to be a massive shakeout, as CHTP had one of the highest down daily volume spikes in the stock’s history. But hold on, things get worse.

Reading the News

I never read the news, but sometimes desperation will push a trader to his limits. I read that the stock had gapped down due to some concerns around a pending FDA approval which would be announced on Tuesday and that the stock would halt trading on Tuesday for the news.

Let me tell you that from Friday until the close on Monday was one of the hardest periods for me in my trading career. Even though I just committed myself to the possibility of a loss down to $1.68, I couldn’t stop myself from thinking, well what if the stock goes to 90 cents or zero! I mean we are talking about a biotech stock and we know how these have made and lost millions for a lot of people.

Accepting the Risks

After it was all said and done, I elected to accept the risk. Good thing for me because the stock gapped up and I was able to make a quick 50% in less than a week. Now, I know this is not ideal, and I rarely find myself in this type of situation. The point is that when I did find myself in a jam, I did not panic. I believed in myself and was prepared for whatever the market had to bring my way.

More Than Penny Stocks

In these examples, I have highlighted my trades in penny stocks. While these charts will look crazy to traders of the S&P 100, the principles remain the same.

You need to make sure you manage your risks, honor your stops and protect your portfolio.

In Summary

There are probably a dozen or more methods for trading bull traps, but in the spirit of keeping things simple, I have focused on the one thing that matters the most – DON’T PANIC.

Panic trading happens far often than most people would like to admit. The reason is most traders are either in concentrated positions or simply have not come to grips with the concept that they can lose the money. This leads to these bull traps, where the weak longs panic during climatic events and unload their shares to the smart money.

So, remember if the market goes against you in a violent way, your stop thresholds have been wildly exceeded and you feel complete hopelessness. Remember to take a deep breath, relax and manage the trade.

External References

- Bull Trap. Wikipedia

- Douglas, Mark. (2000). ‘Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude‘. Penguin Group. p. 21

Chart Patterns

Chart Patterns