Bull bear ratio is a technical indicator that is not quite technical. Unlike most other indicators you might have come across, the bull bear ratio is quite different.

Most traders tend to get lost in the world of technical indicators. As you might know, most of these indicators are based on price. The indicators derive their value based on a formula. These formulae can vary to give you different market information.

Therefore, you have indicators to help you gauge the momentum of the markets. You also have indicators to gauge the market trend and so on.

This is where the bull bear ratio is different. The bull bear ratio is a market opinion indicator. It tells you the opinion of those who are directly dealing with the markets. These include investment advisors, hedge fund managers, and so on.

As a trader, understanding how the bull bear ratio indicator works can be of great help. With this indicator, you will know what the opinion is. As you might already know, the markets can be irrational. The irrationality comes from the people behind the markets. These are the investment managers and hedge funds and other similar experts or professionals.

In this article, we look at what the bull bear ratio is and how it works. You will also learn how to use the information from the Bull bear ratio to apply to your day-to-day trading.

Bull bear ratio – How it works?

The bull bear ratio is a survey that is put into visually understandable data.

Every week, Investor Intelligence conducts a survey of over 100 top investment advisors. The survey asks the investors their opinion about the market.

The responses can be bullish, bearish, or neutral. The survey is then compiled and released every Wednesday.

The data is quantified into the bull bear ratio.

The formula used to quantify the bull bear ratio is as follows:

[Number of Bullish views/ (Bullish + Bearish views)] x 100

Looks very simple right?

Let’s illustrate this with an example.

Say there are 45 advisors who are bullish, 30 who are bearish and 25 advisors who are neutral on the market. We can now quantify this by using the above formula.

[45/(45+30)] x 100 = 60%

This means that overall, investors are 60% bullish.

Now if you keep a record of the values over time, you can get a bigger overview of the markets. If the bull bear ratio was seen consistently rising over the past five or ten weeks, you can see that the optimism is rising.

When you use this information and apply it to the index chart such as the S&P500 you get some interesting results. Using the bull bear ratio, you can see how the market views coincide with turning points in the stock index.

But there is something you should know. Don’t expect the investment advisors to be honest in their responses. This is where things could go wrong. For example, an investment advisor might just tick a box randomly.

A few such responses could lead to an incorrect reading on the index. However, as long as you don’t totally rely on the bull bear ratio as the Bible, you should be fine.

How to use this information, you ask?

Bull bear ratio – How to interpret the data?

You might have heard about this, but there is a frequent saying on Wall Street about making money. Sure, there are many phrases alright. One common saying is that to make money in the stock market, you only have to go against the crowd.

The ironic part though is that even the experts in the field are also wrong most of the time. If you read in the previous section about how the bull bear ratio works, it should be evident by now. The survey is based on the responses from the experts.

The experts are none but the hedge fund managers and investment advisors. The bull bear ratio is built on the responses from these so-called market experts, you can see the irony.

Using the bull bear ratio is very simple. Every time the reading reaches an extreme, you can expect the market to turn around. For example, when the bull bear ratio hits an extremely low reading you can anticipate the stock market to bounce.

Conversely, when the bull bear ratio has an extremely high reading, you can expect a market correction. There is some subjectivity is involved though. In the general market, practice is to stay cautious when the indicator rises above 60 percent or below 40 percent.

These levels start to show how extreme the optimism or the pessimism can get.

Bear in mind though that using the bull bear indicator will not make you rich. Sometimes, the corrections can be brief and you could end up getting caught on the wrong side. Therefore, the information you get using the bull bear ratio should be used along with other indicators.

You should apply fundamental analysis along with market psychology and technical indicators can be of great help.

Bull bear ratio – Does it even matter?

This is a valid question to ask. After all, can you really base your investment decisions on a survey?

But here’s the thing. The bull bear ratio is a quantitative measure of market opinion. These are opinions about people working the market. As you might know, market psychology plays a big role.

Market psychology is so important that there are some people who research into this field as a full-time study. This article is a great starting point to understand market psychology. The 14 stages of emotions an investor goes through are applicable for everyone.

If you still didn’t believe in market psychology, then bubbles are a great example. Take the example of the most recent bubble in the cryptocurrency market. The euphoria drove prices so high that evidently, it became too hard to resist.

This article from Stanford Business looks at the relationship between price and psychology. The study looks at Palm Inc. which was a spinoff from 3Com. At one point the market opinion pushed the price of Palm Inc. even higher than its parent company.

Coming back to the topic of why the bull bear ratio matters think of it as an indicator of the “feel” from the people who are closest to the markets. But again, note that opinions and feelings can change. So by the time the survey is published, the sentiment could easily change.

The sentiment can change for a number of reasons. Perhaps some investment advisors had a bad day, or perhaps there was big news that brought cheer. For example, the stocks initially fell when Trump became President.

But the next day, the sentiment changed on just a speech by the new President.

The bull bear ratio is just an indicator of what the people in the markets feel.

How to use the bull bear ratio in trading?

First off, you should know that the bull bear ratio is not an indicator day traders would use. Because the data is published weekly, sentiment changes take time. Just because investors felt bearish last week doesn’t mean you will profit shorting the market.

Therefore, the bull bear ratio is more suited for swing traders.

You can get the bull bear ratio indicator from most stock market screeners and some charting platforms. There are also many companies that publish the bull bear ratio every week, such as this one.

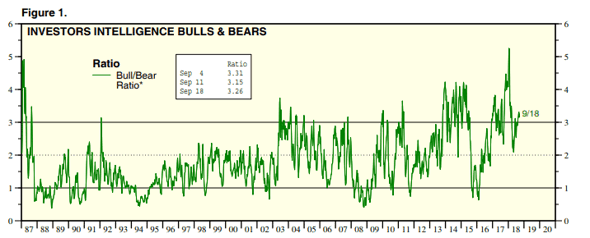

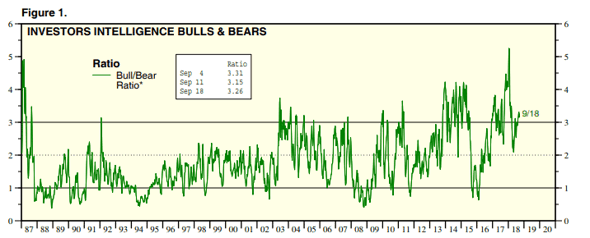

Bull bear ratio report (Source: Yardeni.com)

Click on Stock market indicators and then click on Bull/Bear ratio to get the latest weekly data.

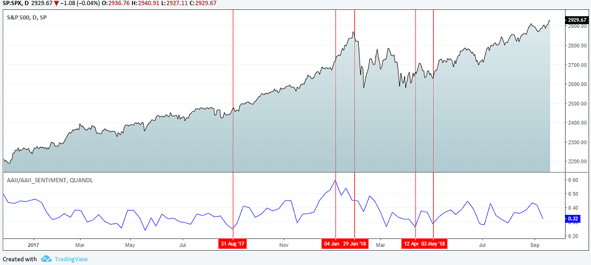

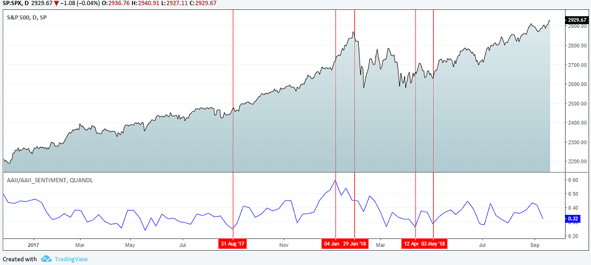

The chart below shows an illustration of the S&P500 index with the Bull bear ratio indicator on the lower part.

Bull bear ratio chart with S&P500 Index

The above chart illustrates how market opinion is quantified into a visually understandable form. The bull bear ratio in the above chart is at the lower part and the indicator oscillators within fixed values. In this chart, we use the levels of 0.60 and 0.40. This is nothing but the 60 percent and 40 percent levels of sentiment.

Whenever the indicator is extremely bullish or bearish you can see the markets turning. Of course, in the above chart, there are instances where the indicator did not exactly get it right. But the main takeaway from the above example is that you can use the bull bear ratio indicator to gauge the market activity.

When there is a steady increase in sentiment you need to ask yourself if it is a good time to buy. Or, if the indicator is steadily falling, should you be selling?

Bull bear ratio – Is it the right indicator to use for you?

What is certain is that you can use the bull bear ratio to time or even gauge the market. You can combine other aspects such as scaling in and out in order to build or decrease your positions in the market.

There are many ways one can use the bull bear ratio. You can for example time your entry into the market. Also, it is important that you do not use this indicator in isolation. You can get validity by using other similar indicators.

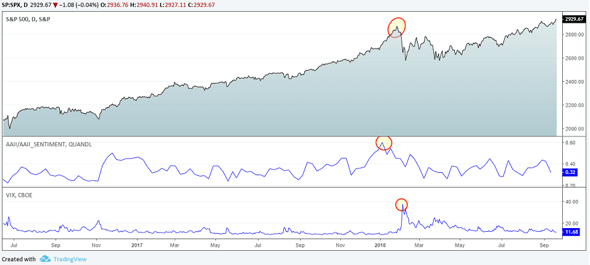

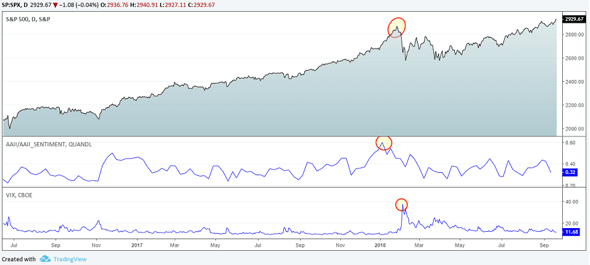

For example, the Chicago Board of Options Exchange (CBOE) publishes its famous volatility or VIX indicator. This gives you the actual position of the put and call ratios in the market.

When you combine the information from the bull bear ratio and the VIX index, you can get a fairly better idea of what is going on. From here on, you can then continue to narrow down by applying your technical strategy to swing trade the markets.

VIX with the bull bear ratio for S&P500

You should also know by now that the bull bear ratio is best used on an index. Therefore, you could look to trading the S&P500 futures or the Dow Jones futures or other derivatives. This way, the bull bear ratio will help you to trade the broader markets better.

Market sentiment indicators

Finally, the bull bear ratio is just one of the many market sentiment indicators that are available. The indicator in question is based on responses from the Investors Business Daily data. The IBD is just one of the many companies that publish the responses.

Other examples that are similar to the bull bear ratio is the survey published by the American Association of Individual Investors (AAII). There are also other sentiment ratios published by large investment banks. However, no matter which way you look, you can almost see the different variations validating each other.

So don’t get too caught up with which data you are using.

As a swing trader, it is important that you stick to one and use that information.

For the most part, the average investor or swing trader often focuses on the day-to-day happenings in the market. However, there are now many different ways to get a good understanding of the market. Of course, this is by no means the way to get rich with stocks.

What the market sentiment indicator such as the bull bear ratio tells you is how you can avoid the traps in the market.

There is a saying about how the trend is your friend. There is also a saying about how the average investor always gets it wrong. With the market sentiment indicator such as the bull bear ratio, you can now get a leg into how the market is thinking.

Breadth Indicators

Breadth Indicators