What is the Bid vs Ask?

Searching for information on bid and ask pricing? Well, you have come to the right place.

The bid and ask are the prices that govern all trading activity.

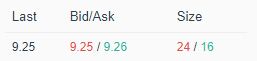

Bid vs Ask

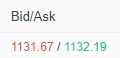

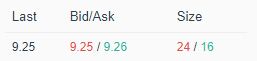

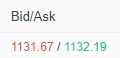

So, what do you think the bid is out of the two numbers above?

Well if you guessed it right, the number in red is the bid number. The bid is the price you are willing to buy the security.

That leaves one other number which is in green – the ask price. The simple way of thinking about the ask is the price you are willing to sell the security.

How Are Orders Ever Executed If Prices are Different?

So, if the two numbers are different, how are trades ever executed? This is a valid question with a simple answer.

If you are a buyer and you must get in the position, you can simply accept the ask price and gain ownership rights to the security.

Conversely, if you are looking to sell immediately, you can enter your order in at the bid price.

What if you are a buyer but are unwilling to pay the full asking price? Similar to what you do when you purchase a car, you offer a little less than the MSRP.

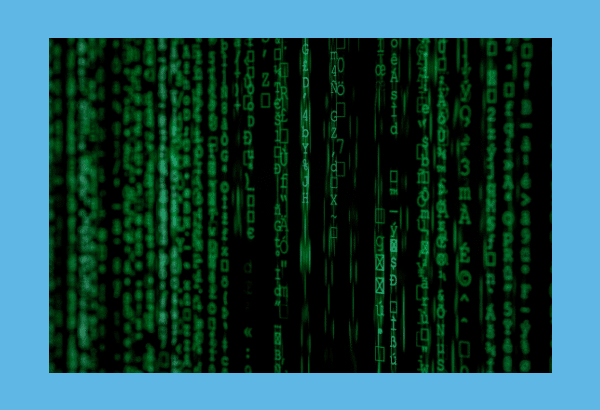

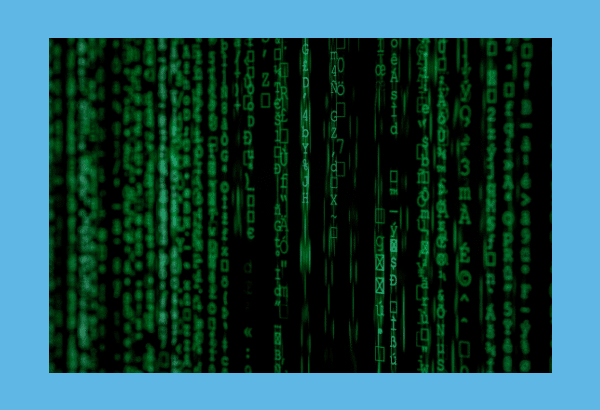

In the above example, instead of offering $1,132.19, you could offer $1,132 even. Your order of $1,132 would now replace the current bid offer of $1,131.67.

Sellers will now see $1,132 and depending on their eagerness to sell may lower their price to meet your offer.

This is the dance which is played on all exchanges around the world – millions of times per day.

What Types of Orders can you Place to Execute at Bid and Ask

I could literally write a 5,000-word article on order types; however, I will keep things simple as the focus of this article is bid and ask prices.

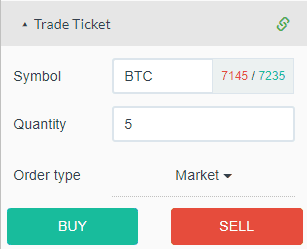

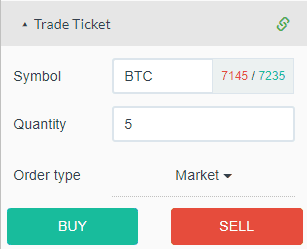

Market Order

Market Order

If you place a market order, your order will be routed by your broker for the best execution at the price which will fill immediately. So, if you are looking to sell out of a position and you sell at market, your order will fill at the bid price.

If you are looking to buy into a stock using a market order, you will fill at the ask price.

Now, if you are buying a thousand shares for example at market, you may fill at multiple price points if the ask continues to rise.

This leads me to the next ordering type – limit orders.

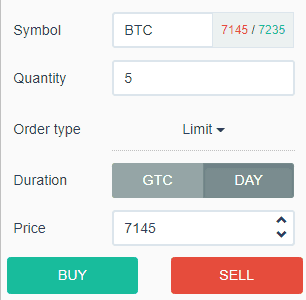

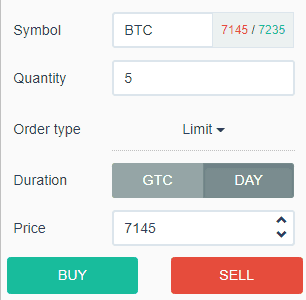

Limit Orders

Limit Order

If you are like me and are always looking to keep your margins tight, then you will want to place a limit order which specifies the price at which you will execute the trade. Therefore, another trader will need to enter an order at the same price for the trade to execute.

You Need to Understand Spreads

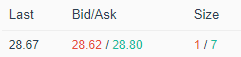

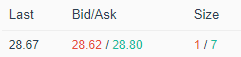

The spread is the difference between the bid and ask price.

This is a really important factor to consider when trading. You can use the analogy of buying a car. Every expert will tell you the minute you pull off the lot you lose thousands of dollars in resale value.

Even though it’s the same car you bought a month ago with only 500 miles on the odometer, to buyers it’s not worth as much as something brand new.

Stocks function in a similar fashion if a security has a large spread. For example, if you bought a stock for $100 dollars that has a bid ask spread of $95 by $100, you would be forced to take a 5% loss just to get out of the position.

The amount of the spread is important to all types of traders, but especially day traders who may need to exit a position within minutes to a few hours.

To give you a sense of spread sizes, here are a few Level 1 screenshots from Tradingsim.

Again, you protect yourself against the risk of slippage and poor order execution by placing a limit order.

Low Volume and Large Spreads

The one thing I will caution you against trading are low volume stocks with large spreads. These securities will lure you in with large price moves in a matter of days.

I want to paint a picture for you. Imagine you are trading a stock that is going against you tremendously, but every time you place your sell limit order it drops by 1% before your order is executed.

This sort of price control (I hesitate to say manipulation) can occur when a handful of traders can control the price action as a result of low liquidity.

It’s better to focus on securities with high volume and tight spreads for best execution.

When to Focus on the Bid and Ask Prices

When to Focus

If you have been trading for any amount of time, you are fully aware of the risks of staring at Level 1, Level 2 and Time and Sales windows all day.

One you can develop headaches from straining your eyes, but even more concerning is the risk of over trading.

Seeing flashing numbers moving at a rapid pace can trigger the need inside of you to do something. Also, staring at numbers for lengthy periods of time can drain at your focus when it matters the most.

So here are a few guideposts for when to zone in on the bid ask pricing action:

- Highs and Lows of the Day

- Key support and resistance levels

- Near your stops and profit targets

If you focus on these three areas, you will be able to discern with some degree of certainty if price will hold or break. This bias one way or another is not likely to reveal itself in the price chart but rather in the pricing and order flow.

Algorithms and Bid vs Ask Pricing

Trading Algorithms

Before the advent of high frequency trading algorithms, you could sit and watch the bid ask prices on Level 1 and come to some sort of conclusion of where the market was likely to break.

In the current trading climate, there are supercomputers sending millions of orders that are cancelled before a transaction takes place.

Why you might ask? The smart money wants to ensure before taking a position there are speculators on the other side of the trade.

Is this legal? It absolutely is and that’s why as a retail trader you are at a distinct disadvantage.

What Can You Do to Protect Yourself from the Evil Machines?

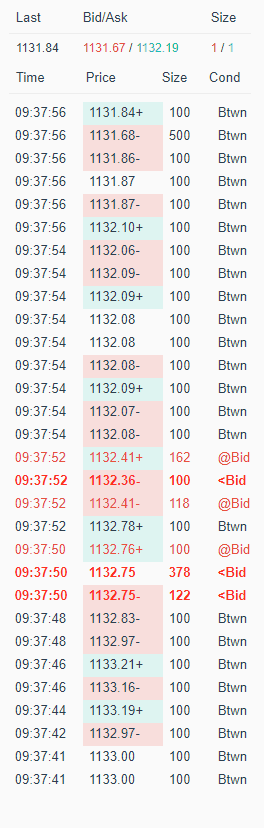

Traders, market makers and trading algorithms can make all the fake bid/ask offers in the world, but you can look at time and sales to verify the pricing and order flow, a.k.a. speed.

Time and Sales

The above image is from the time and sales window of Tradingsim. As a trader, you want to monitor the order flow and that’s where the time and sales window comes into play.

You will see order flow coming through as bid, ask and between orders. If you see the order flow coming in at bid and a ton of red on the tape, then the stock is likely going lower in the short-term.

On the other end of the spectrum, if the market is bidding higher, then you will see orders coming through at the ask and green highlights flashing on your screen.

Bottom line, regardless of what you see on the bid and ask prices, you can focus your attention on the time and sales to see where people are placing their money.

In Summary

You may be thinking; do I really need to know about the details of bid vs ask pricing and order flow.

The answer is – yes!

No matter how good you are as a trader, you are still a human being. To this point, errors are inevitable and one area where traders make mistakes more often than you can believe is on their order execution.

Selling a stock at market instead of at their target profit with a limit order.

Entering in the wrong value in a limit order and when attempting to update the order, the stock has already hit your target level and gone in the desired direction.

Remember, you only need to focus on the bid vs ask pricing at critical price levels and to gain a better understanding of how the security trades before investing your money.

Lastly, stay away from low volume/large spread stocks; don’t worry, you can thank me later.

Day Trading

Day Trading