In this article, I will touch briefly on the background of Gold ETFs and then dive into the most popular gold ETFs centered around the commodity.

Contrary to what Warren Buffett might believe about gold, the precious metal remains a sought after safe haven investment.

Gold ETFs ranks as one of the most popular methods for investors to gain access to the market without having to buy the physical commodity directly.

Three Types of Gold ETFs

As an investor, there are three primary types of Gold ETFs you can invest in.

Buys the Physical Commodity

There are ETFs which buy the physical commodity and then store them in vaults. In this case, you are gaining exposure without having to buy and store gold bars yourself.

Invests in Companies Related to the Gold Industry

The next type of ETF creates baskets of stocks which have direct exposure to the gold market.

Inverse ETFs

These are ETFs which move in the opposite direction of the gold market. Investors can use these ETFs to hedge against long positions or to short the gold market.

How to Evaluate ETFs?

Picking ETFs is a slightly different ballgame than selecting stocks. At its most basic level, an ETF tracks the underlying asset.

Depending on the efficiency of the ETF, they can net a solid return for investors.

When evaluating ETFs, below are key factors to bear in mind.

ETF Expenses: This is the starting point for picking an ETF and is also known as the expense ratio. It is the rate charged by the fund to track an asset. As a general rule of thumb, ETFs with low expense ratios are efficient at tracking the underlying asset.

Performance Relative to Gold: Evaluate how well an ETF is performing relative to the gold contract.

Capital Gains Distribution: ETFs are generally tax efficient but on rare occasions, the funds will need to rebalance itself and these capital gains costs are passed on to shareholders. You can measure this impact by taking the average capital gains paid and dividing it by the NAV. The lower the number, the better the ETF for your bottom line.

To quickly recap, you can use these three forms to measure the very crowded Gold ETF space to find the fund that best matches your investment goals.

4 Popular Gold ETFs

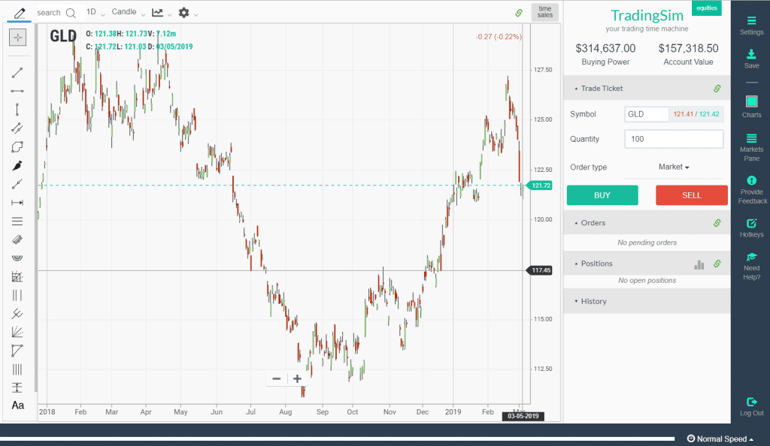

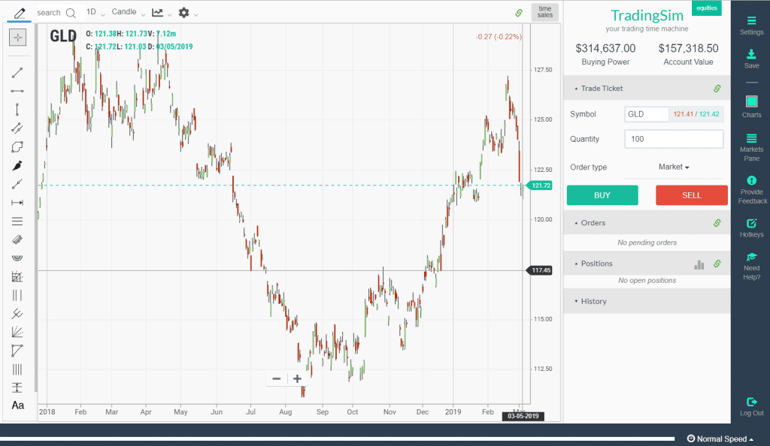

1. GLD (SPDR Gold Trust)

| Name |

Ticker |

Inception year |

AUM |

Avg. Daily Vol. |

Spread |

Expense Ratio |

| SPDR Gold Trust |

GLD |

2004 |

$30.92 billion |

7.8 M |

0.01% |

0.40% |

GLD

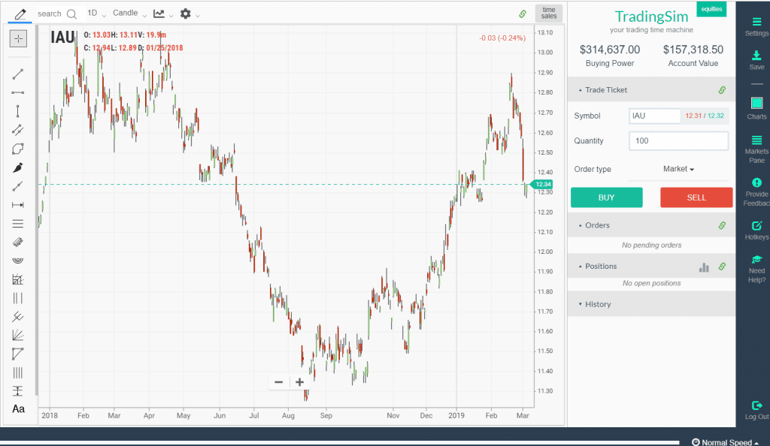

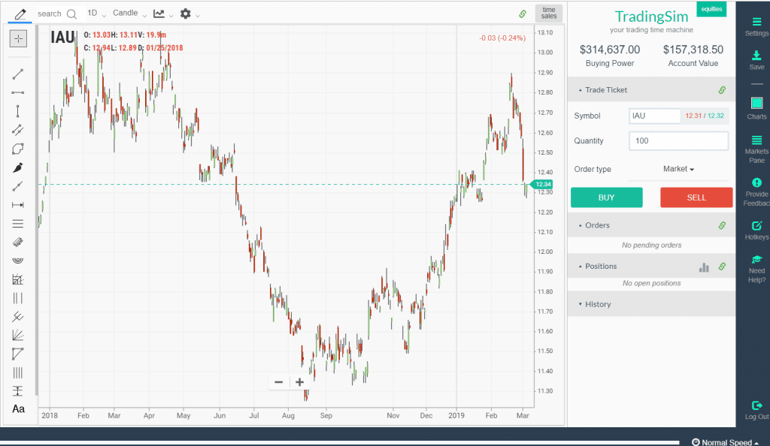

2. IAU (iShares Gold Trust)

| Name |

Ticker |

Inception year |

AUM |

Avg. Daily Vol. |

Spread |

Expense Ratio |

| iShares Gold Trust |

IAU |

2005 |

$7.59 billion |

13.9 M |

0.09% |

0.25% |

IAU fund is considered a low-cost option in the investment world. Birth by the Blackrock corporation, the IAU stores gold in vaults across the world.

IAU

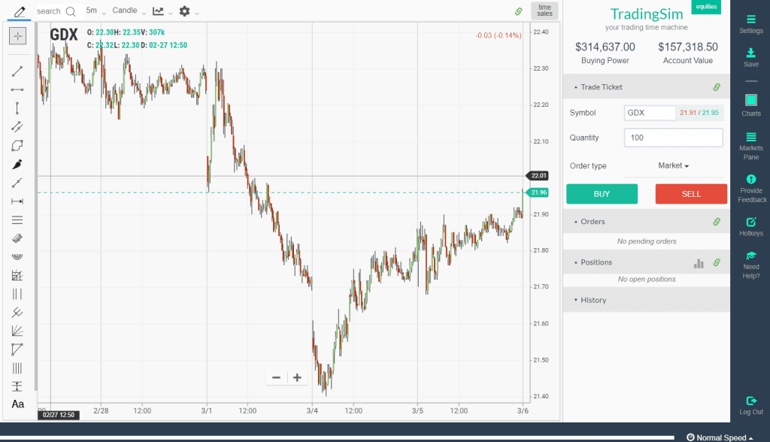

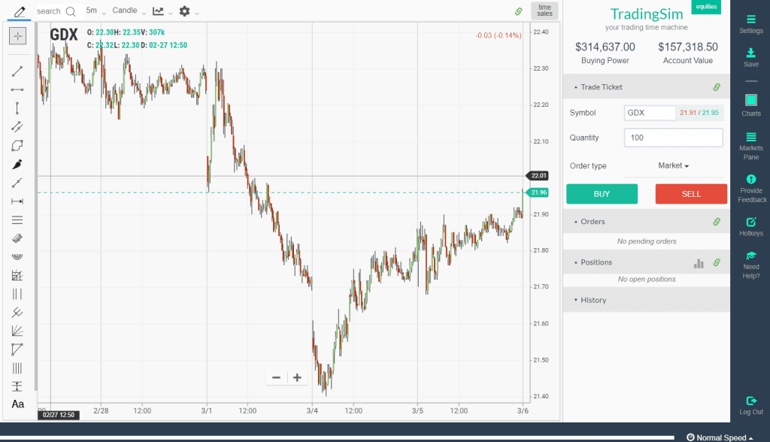

3. GDX (VanEck Vectors Gold Miners ETF)

| Name |

Ticker |

Inception year |

AUM |

Avg. Daily Vol. |

Spread |

Expense Ratio |

| VanEck Vectors Gold Miners |

GDX |

2006 |

$10.06 billion |

43 M |

0.05% |

0.52% |

The GDX tracks a market capitalized weighted index of global gold and silver mining firms, also known as the NYSE ARCA Gold Miners Index.

GDX

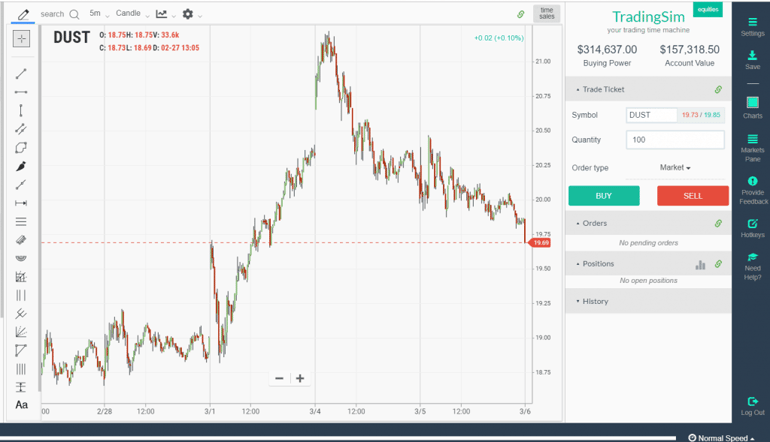

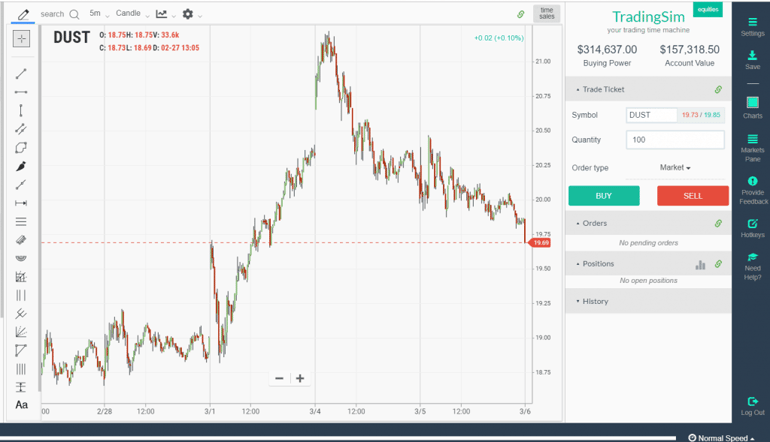

4. DUST (Direxion Daily Gold Miners Bear 3x Shares)

| Name |

Ticker |

Inception year |

AUM |

Avg. Daily Vol. |

Spread |

Expense Ratio |

| Direxion daily gold miners bear 3x shares |

DUST |

2010 |

$260.08 million |

$5.3 M |

0.15% |

0.97% |

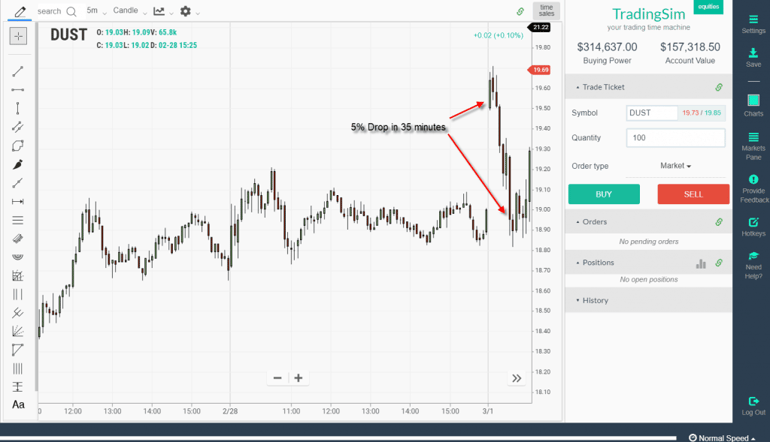

DUST

The Direxion daily gold miners bear 3x shares falls in the category of leveraged ETF’s. As the name suggests, DUST offers three times the inverse exposure to a market cap weighted index of global gold and silver mining firms.

I personally do not trade the DUST, because the 3x leverage exposes me to unnecessary risks due to the increased volatility.

Gold ETF Expenses Rating

Besides the above characteristics, here are the 5 Gold ETFs with the lowest expense ratios. Again, not a sure bet they will be worthwhile investments, but this is a guidepost in terms of cost of ownership for you.

| Symbol |

ETF Name |

Inception |

ER |

Expenses Rating |

| IAU |

iShares Gold Trust ETF |

21-01-05 |

0.25% |

A+ |

| UBG |

ETRACS CMCI Gold Total Return ETN |

01-04-08 |

0.30% |

A |

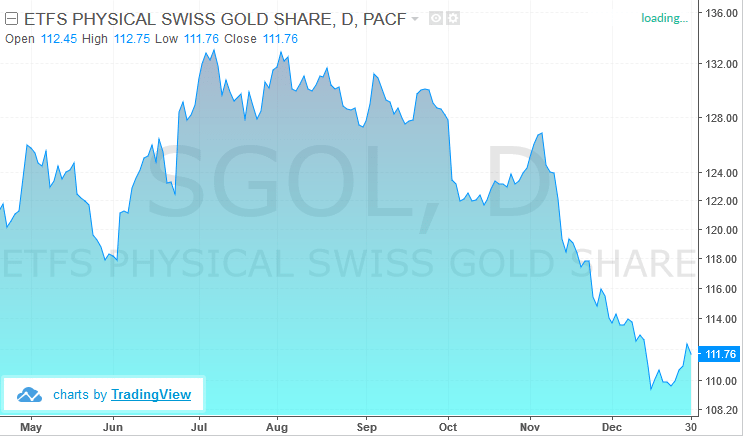

| SGOL |

ETFS Physical Swiss Gold Shares ETF |

09-09-09 |

0.39% |

A |

| GLD |

SPDR Gold Shares ETF |

18-11-04 |

0.40% |

A- |

| OUNZ |

Van Eck Merk Gold Trust ETF |

16-05-14 |

0.40% |

A- |

Source: ETFDB.com

Best Gold ETFs for Traders – Likely Leveraged ETFs

For active traders, you will need to determine which fund demonstrates the price behavior that best matches our trading style. If you talk to day traders the two things they need the most are liquidity and volatility. This allows them to move in and out of positions with ease.

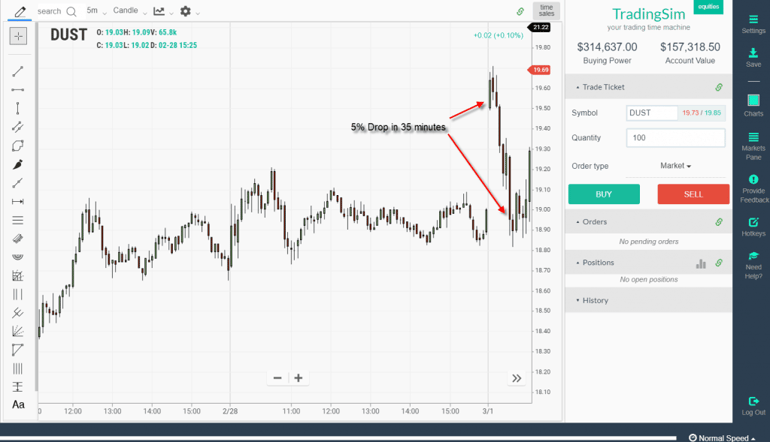

For me, I have had to learn the hard way that leveraged ETFs are not for me.

When I make the wrong trade in these products, they move against me so swiftly I hit my trade threshold within a matter of minutes. For me, I like my trades to set up over 30 minutes up to 2 hours.

So, going down 3% or more in a matter of minutes does not work for my risk parameters.

Notice how there is a 5% drop in 35 minutes right on the open. Now, in this example DUST was able to rebound and rally higher, but what about the times where the ETF just continues lower.

You could face a 7% to 10% loss in a matter of an hour or more.

For some of you, this level of volatility is ok.

For me, it requires me to make decisions faster than my brain can work and then punishes me with a life sentence when I am wrong.

Again, these are just some of the reasons why I do not trade leveraged Gold ETFs, but my gut tells me other day traders will have no problem trading successfully in these securities.

How Can Tradingsim Help?

Are you interested in trading gold, but don’t know where to start? Well, try out Tradingsim and see how you can practice trading all of the Gold ETFs listed on the Nasdaq, NYSE, and AMEX.

You can then see which ETF works best for your trading style before investing any money.

Commodity Futures

Commodity Futures