Selling Short requires more skill than going long. That statement alone may trigger a response from my readers, but I believe that is an accurate statement for a number of reasons.

First, the market has a bias to the upside, as most market participants buy and hold stocks. Secondly, depending on how you hedge your trade, you in theory have unlimited risk of loss when shorting. This concept of unlimited loss presents more complexity in terms of money management and how that is incorporated into your trading methodology.

In this article I will cover 8 reasons of why a trader should avoid shorting a stock. These reasons have been grouped into the following three categories: (1) technical, (2) money management and (3) psychological. At the end of this article you will be able to identify any red flags when it comes to shorting and your trading approach.

In the first section of this article I will be covering the technical signals of when you should avoid taking a short position. Most of these signals will center on moving averages as these are great trend following tools.

#1 Do not short when a stock is above its 30-week moving average

I actively use the 30-week moving average as an integral component of my swing trading strategy. I would love to take full credit for coming up with the 30-week moving average as a trend following tool; however, that accomplishment solely belongs to the great Stan Weinstein. To read more on Stan and the 30-week moving average, please check out his book titled ‘Stan Weinstein’s Secrets for Profiting in Bull and Bear Markets‘.

The 30-week moving average provides the line in the sand for long-term investors that use weekly charts. Essentially the 30-week moving average provides the same information in terms of bull or bear markets as the 200-day moving average for traders that use daily charts.

Below are a few examples of weekly charts and their 30-week moving averages. Please take a minute and go through each chart and identify which stock is in a bull or bear market.

Is Tesla in a bull or bear market?

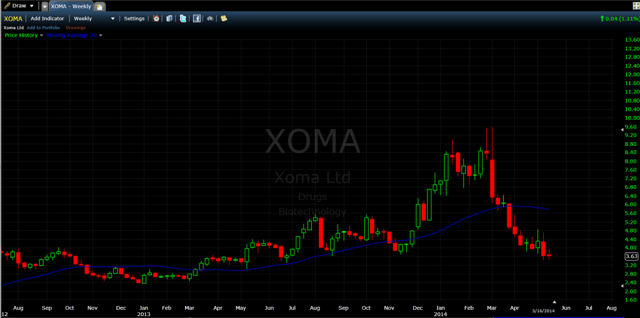

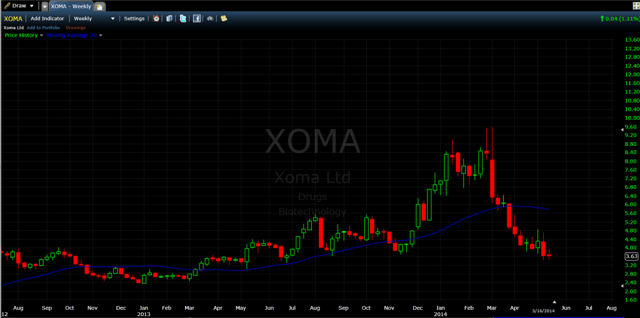

Is XOMA in a bull or bear market?

Is IWM in a bull or bear market?

- First Tesla, based on the strong uptrend, healthy corrections after new highs and the stock holding above its 30-week moving average, TSLA would be classified as being in a bull market. (Bull Market)

- XOMA had a significant break below its 30-week moving average and now has slipped into bear territory after the spring 2014 crash of small cap stocks. (Bear Market)

- iShares Russell 2000 Index Fund ETF (IWM) while below its 30-week moving average has not broken down convincingly. Therefore, the verdict is still out on what direction the ETF will take. The one determination you can make is the ETF is weakening as it tested the 30-week moving average in February, only to retest the average again in early April. Once a security begins to test and retest their 30-week moving average within short timeframes, control is likely shifting from the bulls to the bears or vice versa. The key thing to watch for XOMA in the coming weeks is if the ETF is able to make a new high. If the ETF fails to make a new high and then breaks below the 30-week moving average again, we can safely say the market is now in corrective mode after the 2012 – 2014 bull run. (Trend – To be determined)

One thing I realized early on is that while the 30-week moving average is critical to my trading strategy, other traders could potentially care less. This means that a stock may not turn on a dime at the 30-week moving average. There are times that a stock will penetrate the 30-week moving average, only to shake out weak longs and will then quickly rally.

Again, this is not an exact science, but more of a guidepost for trading on a weekly basis.

#2 Do not short when a stock is above its 200-day moving average

The 200-day moving average provides the same sort of line in the sand for bulls and bears as the 30-week moving average. The difference with the 200-day moving average is the indicator is far more popular than the 30-week moving average.

Generally speaking, the 200-day moving average will lag the 30-week as the 200 day represents 50 more trading days.

However, the same rules as identified for the 30-week moving average are applicable for the 200-day moving average.

Again, I must reiterate that the stock may not turn on a dime when crossing the 200-day moving average, but you will want to avoid scenarios of going short when the stock is significantly below the 200-day moving average.

Using the below images, can you tell which stocks are in a bear or bull market based on the 200-day moving average?

Are the bulls or bears in control of Apple?

Is Yahoo in a bull or bear market?

Do I even have to ask whether EXTR is in a bull or bear market?

- Apple is clearly in a strong uptrend as the stock is approximately 15% above its 200-day moving average. (Bull Market)

- Yahoo is similar to the IWM example above where the bulls and bears are in a bit of a stalemate. (Trend – to be determined)

- EXTR was in a 2 week battle at the 200-day moving average, only to gap down through the average with price and volume. (Bear Market)

#3 Do not short when the stock is in a clearly defined uptrend

My definition of a clear uptrend is when the stock has higher highs and higher lows for the last three consecutive swing points. While you can technically make money trading any type of trend, it will be tougher to profit shorting a stock in a clear uptrend.

I know you are probably thinking, well if the stock is hitting the resistance line, then why not sell the stock short to profit on the pullback. This is a valid argument, but there is always an undefined risk of shorting a stock in an uptrend.

A general trading rule is that whenever the market presents surprises, they are likely in the direction of the primary trend. So, if the market decides to gap through resistance or go off script, odds are this anomaly will be in the direction of the primary trend.

As you can see from the above chart of E*TRADE Financial, if you would have attempted to short the stock while in this uptrend channel, you likely would have been wrong far more times than right. It would have felt like pulling teeth to turn a profit. The grinding action higher in E*TRADE over the last 18 months is a reflection of the shorts entering and exiting the market after each failed attempt.

#4 Do not short highly volatile stocks

Trading highly volatile stocks is the key to making fast money in the market, assuming you know what you are doing.

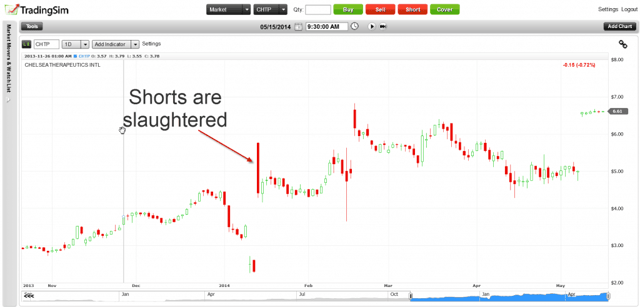

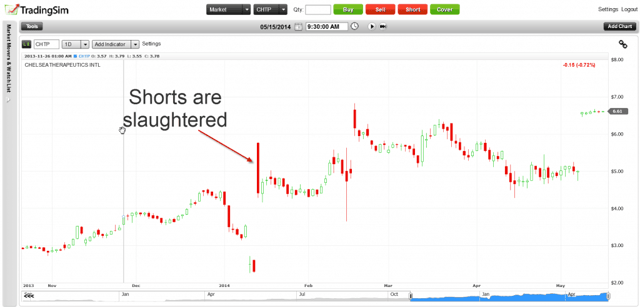

In today’s market, the high flyers are the biotechnology stocks. These stocks will rally or fall on earnings reports or results from clinical trials quicker than any of us can blink.

Below are a few charts of biotechnology stocks that rallied hard after pullbacks. For me, it’s not necessary to introduce this level of risk into my swing trading strategy. There are just far too many other ways to make a buck in the market.

So, to avoid the potential for huge losses, if you must trade volatile stocks, only trade them on the long side.

#5 Do not short if the market is in a strong bull market

If you see the market is in a strong uptrend, do not go out there guns blazing shorting everything in sight. I know calling a major market top is like the unicorn for technicians, but why not just ride the wave higher so you can make money with the wind at your back.

Stepping in front of a strong bull market is a sure recipe to losing your hard earned money.

Below is a chart of the iShares Russell 2000 Index Fund ETF (IWM) from late 2012 through March of 2014. Can you please explain to me why you would fight this level of bullishness?

Money Management

Trading is not only about being right, but being right at the right time and having enough capital on-hand to weather any storms. While the next few sections aren’t as glamorous as shiny stock charts, please do not discount their importance.

#6 Do not short stocks with strict margin requirements

After the previous section on highly volatile stocks, it’s a great segue to strict margin requirements. While you may feel like you are ready to take on the world, your brokerage firm may think otherwise. These firms will provide strict margin requirements for trading volatile stocks based on the level of risk exposure they are willing to accept.

So, when you decide to short an extremely volatile stock, the margin requirements are often so strict that you are practically forced to only use your available cash. If you see that a stock has ridiculous margin requirements, it’s probably best to avoid trading the security since it will greatly reduce your ability to trade with margin.

Beyond just trading with margin, if you were to encounter any of the sharp rallies like we just reviewed with the biotechnology stocks, you will likely get a margin call. This will force you to either add more cash to your account or you will need to close out the losing position. Traders will say, well if the stock rises from $2 to $6 dollars, I will just wait for the pullback. This is true if you have enough cash on hand. Most traders are either over leveraged, which is why these volatile stocks rally so quickly, because shorts are forced to liquidate their positions by their brokerage firms to meet the margin requirement

#7 Do not short if you are using a good portion of your margin

Even if you are shorting blue chip stocks and the margin requirements are relaxed (less than 35% cash required), you still can get in over your head if you were to use 150% or the full 200% of your marginable equity for shorting. Unlike long trades, without a hedge, you essentially have unlimited risk when shorting. If you read this last sentence and are still thinking to yourself, “What’s the big deal with using so much margin?” You are likely suffering from market greed and at some point will completely blow up your account.

If you are using all of your available cash for trading, do you think it’s wise to then use margin to place more money at risk when shorting?

Psychological

At the end of the day, if we strip away all of the news, charts, opinions, etc. we are left with our belief system as an individual trader. If you do not have a winning attitude, don’t bother getting involved in this game. Below is the key psychological question you need to challenge yourself on as it relates to shorting.

#8 Do not short if you can’t handle the concept of unlimited risk

When shorting, you in theory have opened yourself up to unlimited risk unless you have hedged the trade. Now if you are ok with that fact, shorting will feel the same to you as going long in a stock. However, if you as a trader have not embraced the fact the market could continuously run against you, any rally will create an enormous amount of anxiety.

If you feel that you are unable to muster up the intestinal fortitude for shorting, it’s in your own best interest to stay on the long side of trading.

In Summary

Shorting can be an extremely profitable means for trading the market. I myself have and will continue to short the market when opportunities present themselves. You just have to look at the market through a different lens.

If you read a few of the above 8 explanations for why not to sell a stock short and it gave you reason to pause, then head over to our homepage. You can try shorting using our trading simulator to see if there is any merit behind your hesitation.

Good luck trading!

Al

Photo Credit

Stock Images courtesy of Freestockcharts.com

Crypto

Crypto