One of the benefits of trading futures is the fact that traders can get access to just about any major stock index or an exotic currency in the futures markets, with the benefit of trading on margin or leverage. While Japan’s Nikkei 225 or the London FTSE100 futures are some of the non-American equity index futures markets that one can trade, the NIFTY50 futures makes for an interesting stock index futures to trade.

For futures day traders who are on the lookout of more interesting markets away from the regular ups and down in trading the more popular S&P500, Nasdaq or the Dow emini contracts, the NIFTY50 futures offers just the right level of excitement and variety. If you have traded the U.S. equity indexes and the Japan’s Nikkei225 index futures, there is a certain level of correlation between the index futures price movements. The NIFTY50 index on the other hand behaves a bit differently making it quite unique. Due to India’s position as one of the leading emerging market economies and its position of strength in Asia, the NIFTY50 futures contracts make for a unique trading instrument. Futures traders who like volatility will find trading the NIFTY50 futures contracts to be enjoyable.

The NIFTY50 futures contracts track the prices of the underlying asset which is the NIFTY50 cash markets. Here are seven things a futures trader should know before you start trading the NIFTY50 futures markets.

1. NIFTY50 is one of the leading index for India’s stock markets

NIFTY50 index is the benchmark stock market index for the Indian equity markets on the National Stock Exchange (NSE) and is one of the two main benchmark indexes for the Indian subcontinent. The other main index besides NIFTY50 is the Sensex, used by the Bombay Stock Exchange of BSE, which tracks 30 companies. The NIFTY50 Index was formerly called the S&P CNX Nifty Index until 2013.

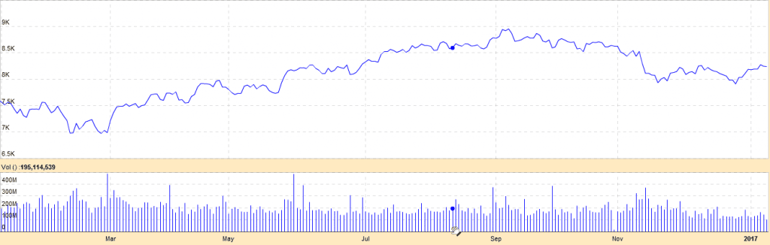

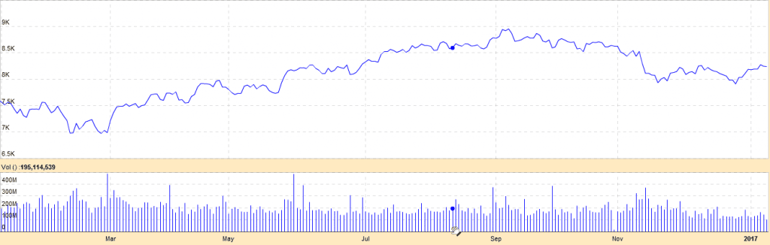

NIFTY50 Stock Index Chart

The name is derived from National and 50, which combined becomes NIFTY50. The index is owned and managed by India Index Services and products (IISL). The NIFTY50 is not to be confused by the large cap stocks from the NYSE used in the 60’s and 70’s and included companies such as Disney, Coca-Cola, and Dow Chemicals and so on.

The Nifty50 is a benchmark index for India, which was launched in 1995 and is relatively new. The index tracks 51 companies. The NIFTy50 index is a capitalization weighted index and made up of a wide range of sectors from Pharmaceuticals to Media & Entertainment to IT and Automobiles sectors. Overall, there are 24 sectors that make up the NIFTY50 index. The NIFTY50 index was formed in 1995 with a base value of 1000.

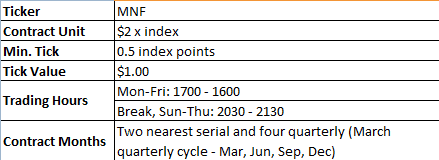

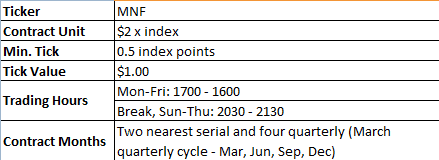

2. NIFTY50 Futures Contract Specifications

The futures ticker symbol for NIFTY50 is MNF on the Globex electronic platform. The NIFTY50 futures contract is priced in U.S. dollars, unlike the NIFTY50 index which is priced in Indian rupees. The contract size is a multiple of $2 times the index value, meaning that if the NIFTY50 index is at 8000, the contract size is $2 times the index or $16,000. The NIFTY50 futures contract is available as e-mini version only and has a minimum tick size of 0.5 index points. Each index point is valued at $1.00

Trading on the NIFTY50 futures contract is the same with trading hours from Monday through Friday, starting from 4pm the previous day through 5pm on the current day with a 1-hour trading break from 8:30 through 9:30 PM.

One of the unique aspects of trading the NIFTY50 futures contract is that similar to the Nikkei futures, the NIFTY50 contracts come under the mutual offset system (MOS). This means that the NIFTY50 futures contracts can be settled either at the CME Group futures exchange or the Singapore Exchange (SGX). A trader can designate a trade as an MOS before execution and then choose whether CME or SGX will carry the position.

Below is a summary of the CME Group’s emini NIFTY50 futures contract specification.

NIFTY50 Futures Contract Specification

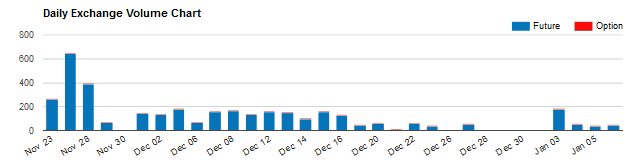

3. Low trading volumes and trading hours

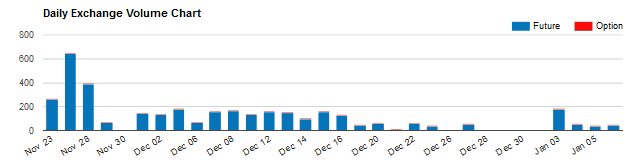

The NIFTY50 futures contracts aren’t the most actively traded futures contracts. On average the volume on NIFTY50 futures are around 600 – 800 contracts. It is normal for the NIFTY50 futures contract to see low volumes on most days in only double digits. This lack of sufficient trading volumes can pose a risk for most futures day traders and a large volume of orders can significantly move the prices.

NIFTY50 Trading Volumes

Due to the low volumes, not all retail futures brokers list the NIFTY50 futures contracts and therefore futures day traders who want to trade specifically the NIFTY50 futures will need to shop around for the futures broker that offers trading the NIFTY50 futures contracts.

Besides the lower trading volumes, the trading hours on the NIFTY50 futures also plays a big role. The NIFTY50 cash market trades from 9:15AM – 3:30PM on weekdays, which is about 9:45PM through 4AM central time. Therefore, traders based in the U.S. will need to stay awake during the cash market hours where liquidity is higher than usual. The futures markets open 15 minutes before the official cash market open, which is the pre-market trading hours where some amount of liquidity can be seen.

4. NIFTY50 Futures intraday trading strategies

Due to the fact that the NIFTY50 tracks the 50 (51) large cap stocks in the Indian stock market it is one of the sophisticated index for trading a basket of stocks. Due to the fact that no individual stock can influence the index significantly, it is easier to trade the NIFTY50 based on technical analysis alone, similar to trading the emini S&P500 futures or the emini Dow contracts. However, as mentioned in the previous item, day traders need to ensure that they trade during times of sufficient liquidity and trade during the cash market hours in order to avoid being trapped into a position on low volume, which can then turn risky as volumes dies out as the cash market closes.

There are many technical strategies that have stood the test of time on the NIFTY50 futures price charts. Day traders can start with the most basic, moving average crossover, or trading the first trading hour of the NIFTY cash markets in order to day trade for a few points. The day trading futures margins for the NIFTY50 contracts are usually around $200 – $500 making it a lot more affordable to trade on lower capital.

5. CME NIFTY50 futures, not to be confused with the local NIFTY futures

While the CME futures offers the NIFTY50 futures contracts, these are not to be confused with the NIFTY futures contracts offered on the National Stock Exchange. The main difference between the local NIFTY futures contracts and those offered by the CME Group is the contract size, value and the pricing itself. For example, the local NIFTY futures contracts have a contract size of 25 units with the contract value being a multiple of the contract size (25 times index value in Indian rupees).

Besides these primarily differences, the local NIFTY50 futures trade in a same way, meaning the prices are marked to market on a daily basis and trading the NIFTY futures is done on margin.

6. Factors that affect valuation in the cash markets

Trading the NIFTY50 futures, although technical, still requires traders to keep an eye out on the fundamentals. However, the fundamentals that govern the NIFTY50 stock index which is the underlying market is usually a bit different than compared to trading the actual stocks. Broadly put, fundamentals such as inflation, GDP play a major role in determining the momentum in the stock index. Unlike the advanced economies where interest rates are close to zero and seldom move twice during a year, emerging economies have different dynamics in play.

Interest rates can be changed, sometimes with warning and sometimes coming as a surprise to market participants which eventually tends to influence prices of the NIFTY50 index quite adversely.

Besides monetary policy, there are also geo-political and other risks that are common to emerging markets such as India. For example, the most recent case of demonetization, which took the Indian markets and the world by surprise led to a 4.3% decline on the NIFTY50 index on a single day.

While technical analysis can help, totally unforeseen events such as these tend to play havoc on the markets and something that futures day traders need to keep an eye on. It can be a bit difficult especially due to the time zones and the market hours.

7. Influence of the U.S. dollar’s exchange rate

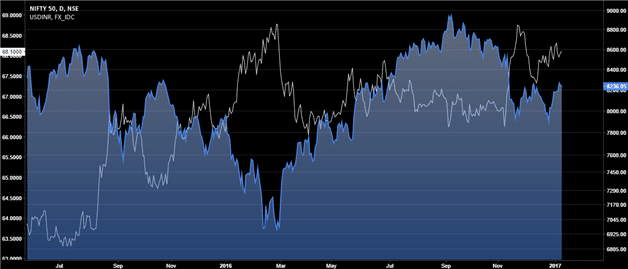

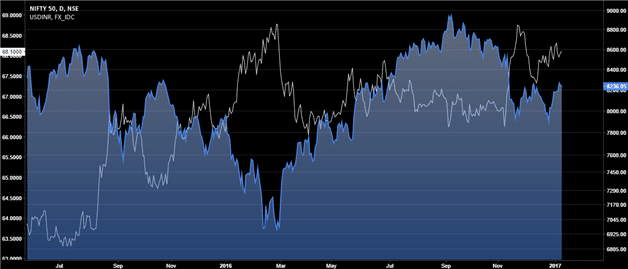

The U.S. dollar’s exchange rate also plays a major role when it comes to influencing the price of the NIFTY50 index. Although the USDINR exchange rate is not one that is widely used, the exchange rate plays a crucial role for sectors such as Information Technology and other companies that are used as outsource hubs. Typically a stronger Indian rupee tends to eat into the profit margins for the services export oriented companies while a weaker Indian rupee tends to have a positive impact.

Although no each company listed on the NIFTY50 index has a single highest weightage which tends to balance the risks on the index, keeping track of the exchange rate for USDINR is important if you want to trade the NIFTY50 futures in the long term.

Besides the monetary policies from the U.S. that affect the dollar, NIFTY50 futures day traders should also focus on monetary policies from India’s Reserve Bank as well which. Bear in mind that USDINR does not attract high volumes despite the Indian rupee being a free floating exchange rate.

The chart below shows the overlay of the USDINR exchange rate (white line) and the NIFTY50 cash market index.

NIFTY50 Cash Market Index (Right) and USDINR (Left)

In conclusion, the NIFTY50 futures contracts are one of the more exotic futures contracts which track the NIFTY50 cash markets from India’s National Stock Exchange. Due to the fact that the NIFTY50 futures contracts are exotic, the trading volumes are typically lower, meaning that futures day traders need to be very cautious in order not to get trapped by illiquid market conditions.

Another major factor to consider when trading the NIFTY50 futures contract is the timing of the actual market hours. Whatever little volume one gets to see on the NIFTY50 emini contracts are during the cash market trading hours which is closer to 9:45PM central time thus putting the contract out of reach for most traders in other time zones.