The British pound is the currency of the United Kingdom and is one of the major currencies used by banks worldwide and therefore it is also referred to as a Major currency. In fact the Pound sterling as it is commonly referred to be one of the oldest currencies in the world, dating back to the 8th century. It is the fourth most traded currency in the foreign exchange markets and also holds value as a third most held reserve currency in most global forex reserves.

The British pound futures contracts began trading since 1975 and are part of the currency futures category. The pricing for the British pound futures is based on the U.S. dollar and the futures contracts track the underlying asset which is the spot rate of the GBPUSD currency pair.

Trading the British pound futures, traders are able to manage risks by hedging or speculate on the price volatility. In the British pound futures, the base currency is the pound sterling while the quote currency is the U.S. dollar. Thus the pricing on the British pound futures represents the value of 1 British pound to the U.S. dollar. The British pound futures can be settled for cash or for physical delivery as well. However, for day traders, the futures contracts are settled for cash with the contracts being automatically closed before the last trading day.

The British pound futures are standardized contracts and cleared via the CME exchange. You can also trade the British pound futures on the ICE exchange or the Eurex which has a similar contract specification to that from the CME group, but as far as volume is concerned, the exchange volume at CME for the British pound futures is a lot higher than the volume from the ICE listed British pound futures.

While the Pound sterling has been relatively trendy currency to trade against the U.S. dollar, recent political developments in the country has kept the currency very volatile. For speculators this volatility translates to good short term trading opportunities in the markets. With low intraday margin requirements for trading the British pound, traders can easily access the currency markets to trade the British pound futures.

In order to be able to effectively trade the British pound futures contracts, here are six key things you should know.

#1. British Pound futures contract types

The British pound futures are standardized contracts with each contract size of 62,500 British pounds. There are many different contract types for the British pounds starting from the standard contract and the e-micro futures contract. However, when you compare the volume, the standard British pound futures contract clearly stands head and shoulders above the e-micro futures contracts.

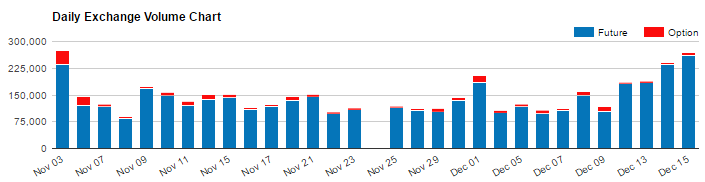

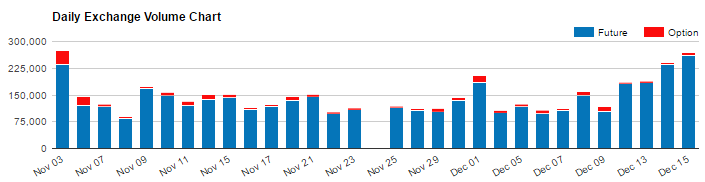

On average, the standard British pound futures contract has an average value of 150,000 contracts on a daily basis. This high level of liquidity ensures that day traders are able to trade the British pound futures contracts with relative ease without affecting prices or liquidity.

British pound futures contract volume (CME Group)

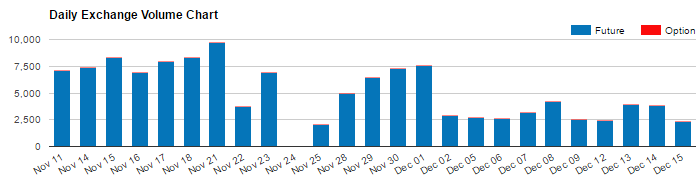

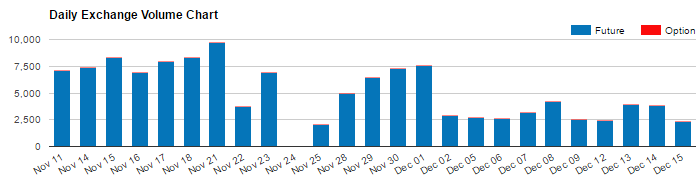

In comparison, you can see that the volumes on the e-micro British pound futures contracts are less with an average daily volume of just 7,500 contracts.

British pound e-micro futures contract volume (CME Group)

#2. British pound futures contract specifications

The standard British pound futures contract has the following specifications.

| |

Standard British pound futures |

e-micro British pound futures |

| Ticker |

6B |

M6B |

| Trading hours |

CME Globex: Sundays: 5:00pm – 4:00pm CT next day.

Monday – Friday: 5:00pm – 4:00pm CT the next day, except on Friday – closes at 4:00pm and reopens Sunday at 5:00pm CT.

|

Sundays: 5:00 p.m. – 4:00 p.m. Central Time (CT) next day. Monday – Friday: 5:00 p.m. – 4:00 p.m. CT the next day, except on Friday – closes at 4:00 p.m. and reopens Sunday at 5:00 p.m. CT. |

| Contract Size |

62,500 |

6,250 |

| Minimum Tick |

$0.0001 per British pound increment |

$0.0001 |

| Tick Size |

$6.25 |

$0.625 |

| Contract Months |

Twenty months in March quarterly cycle |

Two months in the March quarterly cycle (Mar, Jun, Sep, Dec) |

As with any futures contracts, traders are required to put up a performance bond or an initial margin and have a maintenance margin. The CME futures group has a standard initial margin requirement or around $3950. However for day traders, the margin requirements are a lot less, averaging around $500 or so depending on the futures broker that you trade with.

#3. British pound futures pricing

The British pound futures are priced in 4 decimals with the GBP being the base currency and the USD being the quote currency. The British pound futures track the prices of the spot GBPUSD fx markets which is traded over the counter. Prices are settled on a daily basis on a mark to market. Unlike the spot fx markets where overnight positions often attract positive or negative rollover swaps, in the futures market, the British pound futures contracts automatically price in the interest rate differentials. Therefore there are no overnight swaps or rollover fees levied.

With each tick (0.0001) representing $6.25 on the standard contract, a typical 100 pip move on the British pound futures contract accounts to $625.00 or a full 1 cent move is equivalent to $6250.00.

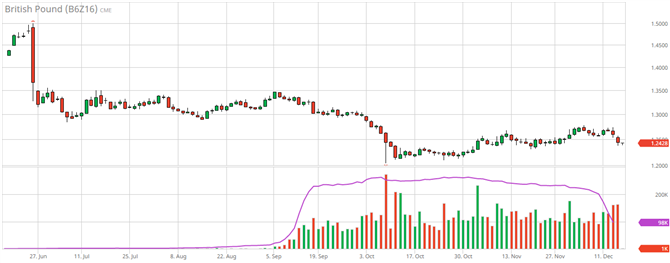

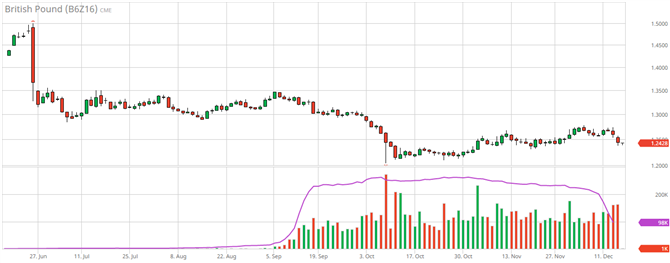

British pound futures price chart (Source Barchart.com)

Due to popularity of the British pound, trading can be done at any time, although volatility is higher during the start of the London trading session which is at 7AM London time (GMT+1). Volatility dies down towards the lunch session but then picks up as there a good few hours of overlap with the U.S. trading session. It is during these periods the British pound futures experience higher volatility.

#4. What makes the British pound a popular currency?

Besides the facts such as being one of the oldest currencies in the world and a major currency, the primary reason behind the popularity of the British pound is its location. London is one of the major global trading hubs in the world and is one of the busiest and the largest transaction centers where the GBP is used as the main currency. As a floating exchange rate, the GBP/USD which is the underlying asset is also attractive for traders on both sides of the Atlantic.

The high liquidity in the currency pair makes it easy for traders to buy or sell without any difficulty. The GBP/USD is referred to in the trading circles as the Cable. The name comes from the undersea cables that connected New York to London for direct transmission of price quotes, which earned it the nickname of cable.

Before the U.K voted to leave the EU, London was seen as a window to the European Union which comprises of 28 nations. For many, it was as easy as transacting with London which could then passport its services onto the 28-nation economic bloc. However, this is likely to change over the coming years although there are a lot of unknowns as to whether the UK will still be able to maintain its role as the financial trading hub in Europe.

From a trading perspective, the British pound is known for its volatility and sharp price movements making it ideal for intraday futures traders to grab a few pips from the volatility.

#5. Economic factors affecting the British pound futures

In June 2016, the UK held a referendum on whether to continue its membership in the EU or to part ways. The UK voted to leave the EU membership which sent the markets into a financial tailspin before stabilizing after efforts by the Bank of England and political leaders.

While the British pound is influenced the regular factors as trade balance, economic growth and inflation, the decision to part ways with the EU, also known as Brexit has been another important factor when it comes to influencing the exchange rate.

In fact, right after the UK voted to leave the EU, the British pound fell to a 30-year low. Since June, the British pound has exhibited higher volatility than usual with the ongoing Brexit talks that is likely to extend into the next year. Bear in mind that despite voting to end its membership to the EU, the UK is yet to trigger the exit clause, which is currently entangled in legal hearings.

Besides Brexit on a day to day basis, the central bank’s monetary policies play a crucial role. The Bank of England meets eleven times a year on a Thursday to review the economy and prepare the markets for the rate decision. The central bank’s decision making committee is made up of nine members of whom five are the Bank staff made up of the Governor, three Deputy Governors and the central bank’s Chief Economist. The remaining four members are independent experts chosen from outside the bank.

The British pound is prone to be volatile to any off-the-cuff remarks by any of the central bank policy members and highly susceptible to comments from any of the three deputy governors and the central bank governor himself.

In order to be positioned correctly to trade the British pound futures, traders need to look at the weekly economic calendar in order to prepare for any potential market moving events especially speeches by the said policy makers. Besides the central bank staff, in light of the current Brexit environment, comments from government leaders can also easily influence the exchange rate of the British pound. Unfortunately most of these comments are unscheduled which only heightens the importance that traders need to be extra careful when trading the British pound futures.

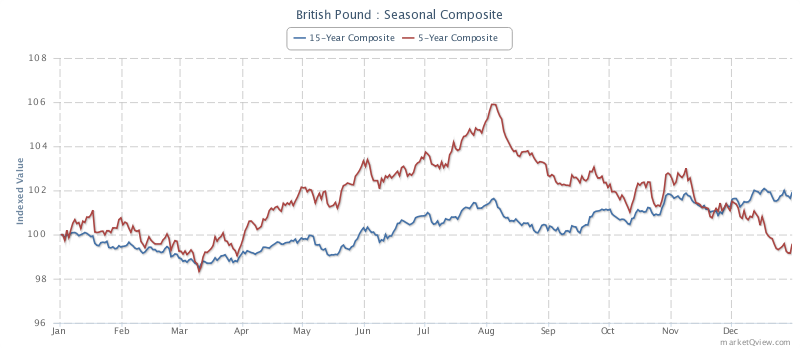

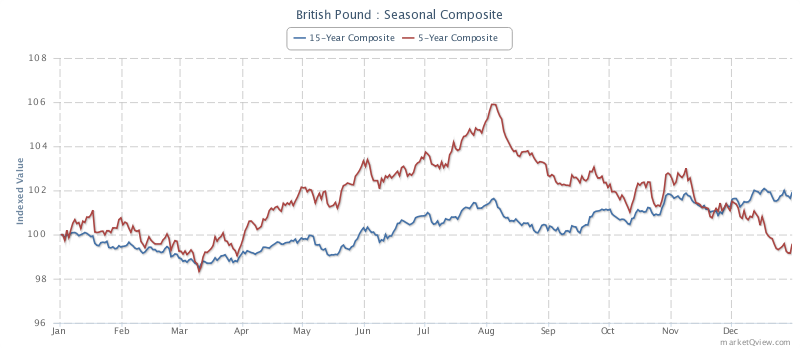

#6. British pound futures seasonal tendencies

The British pound also follows a seasonal cycle with prices starting to pick up from around March – April before typically posting a high around August – September. Thereafter the British pound starts to post lows into the end of the year. This seasonality of course can be put to question especially after the Brexit event which is likely to put a dent on the seasonal tendencies of the British pound.

For example, this year, the British pound futures posted steep declines in the June – July period after the Brexit vote, which was a bit earlier than the typical August peaks that are formed under normal circumstances.

British pound futures seasonality (Source Marketqview)

Nonetheless, the chart above shows a typical pattern in the British pound futures which can be used to one’s advantage.

The British pound futures are one of the most ideal, liquid currency futures that you can trade. Due to the history behind the currency, the British pound is one of the oldest and is a major currency pair which means that traders can take advantage of the liquidity that is available on the GBP futures to successfully day trade the futures contracts.

Commodity Futures

Commodity Futures