The 52-week range is a technical indicator, which pinpoints the low and high of a stock during a 52-week period.

In other words, you target stock price for the 52-week high/low.

52-Week Range

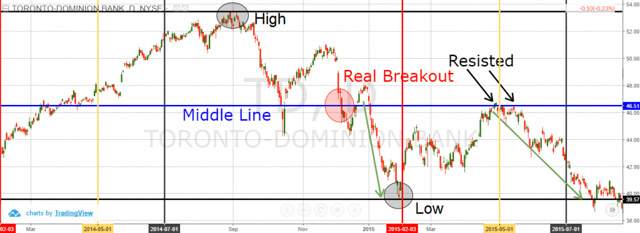

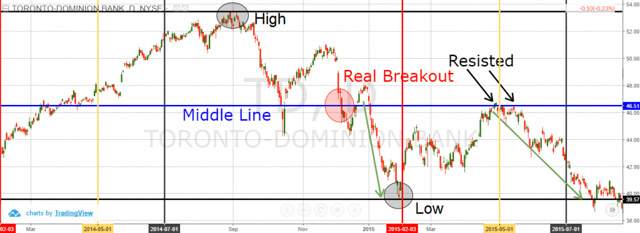

This is a 52-week range example. The vertical lines on the chart measure a 1-year period from July 2014 until July 2015.

The high point of the range is from September 2014 and it is located at $53.45 per share. The low point of the range is from February 2015 at $39.57.

3 Techniques with the 52-Week Range Indicator

At this point, you might be thinking, “How can I use the 52-week range when trading?”

This is a great question. Before we dig into the three techniques, I first want to impart on you the importance of the 52-week range.

First and foremost, large institutions track the 52-week range low and high. This means that you will see either buying or selling pressure around this key area as it translates to a company’s ability to turn a profit on a year-over-year basis.

Secondly, retail traders will place their stops at these levels when going counter to the primary trend. For example, if a stock has been crushed and then has a technical rally, many retail traders will buy into that event and then place their stop slightly below the yearly low.

Therefore, you will see a ton of orders hovering around these yearly levels.

Well, enough preaching, let’s now dig into the three techniques.

#1 – Defining Trade Targets with the 52-Week Range

So how does the 52-week range indicator provide a potential profit target?

Let me show you the math behind this statement.

Average Weekly Size = (A – B)/52

A: 52-Week High

B: 52-Week Low

In other words, we simply identify the size of the 52-week range by subtracting the 52-week low from the 52-high. Then we divide this value by 52 in order to find the average weekly move of the price.

Let’s say the 52-week high of a stock is located at $452.00 per share and the 52-week low is $374.00 per share.

Average Weekly Size = (452 – 374)/52

= 78/52 = 1.5

This means that the average weekly move of the stock is equal to $1.50 per share.

Before all of your Ivy League statisticians start jumping down my throat, this is simply a method for gauging future price movement based on historical action.

In reality, a more accurate method for gauging price action is to use the daily values versus weekly.

It acts the same way with defining the average weekly price move, but this time, you divide the size of the range by 252.

I bet you are wondering why we divide by 252 instead of 365.

It’s a pretty simple answer, the markets are not open 7 days a week.

Furthermore, every country has official holidays, when their respective markets are closed. Hence we have approximately between 240 and 252 trading days a year depending on the country you trade.

Let’s further explore the math behind the average daily size.

Average Daily Size = (452 – 374)/252

= 78/252 = 0.3095238095238095, which equals approximately $0.31.

Therefore, the average daily size of our stock equals $0.31 per share.

Now that we know the daily size of our stock, we can take this amount as an average expected during the day. If you manage to catch a trend, you may stay in your trade for a move of at least $0.31 per share, or until the market closes.

Let’s now measure the size of a few daily ranges and compare their size from the result of the average daily size formula:

52-Week Daily Ranges

This is the daily chart of Kraft Foods. The image shows a 52-week range between February, 2014 and February, 2015. The high of the range is $67.70 per share and the low of the range is $50.51.

Let’s now calculate the average weekly size with the help of our formula:

Average Weekly Size = (A-B)/252

A (high) = 67.70

B (low) = 50.51

Now let’s apply these parameters to the formula:

Average Weekly Size = (67.70 – 50.51)/52

Average Weekly Size = $0.33

#2 – 52-Week Range Breakout

Once you have identified the 52-week range, you can begin hunting for breakouts at this level.

The easiest way to spot a breakout in the 52-week range is by monitoring the size of the range (A-B) as discussed above.

A simple method to trade is to look for stocks that are approaching huge psychological levels. For example, levels such as $10, $25, $50 or $100.

These levels are critical as some asset managers have minimum price requirements before they can add to their portfolio. This is often the case once a stock clears $10.

My personal favorite is $100. This is a classic number which when broken will often lead to a nice rally.

The key thing about trading breakouts on any timeframe is to keep your hand close on the trigger in the event things fall apart.

Remember, just as quickly as these stocks shoot higher, they can reverse on you in a heartbeat.

52-Week Bearish Breakdown

Above is the daily chart of CBS on the NYSE from August 18, 2014 through August 18, 2015. This period is also our 52-week range indicator.

The price action begins to hover around the low for approximately two weeks. Then the break happens and CBS slams lower in an impulsive pattern.

Notice that when trading 52-Week Range breakouts, the size of the range changes in every next period after the breakout. In our case, the low point of the range changes with every next period, which is lower than its ancestor.

When trying to determine the target for the breakout, you can assume the size of the range. If the range is extremely large, you can then target half of the range or a third for when to exit your position.

#3 – 52-Week Range Middle Line Breakout

This technique includes the usage of a middle line in the 52-Week Range. When you define the size of the range, you should simply add a line, which goes right through the middle. You can use the following formula to get the middle line:

(High + Low)/2

Next you need to scan for breakouts or stocks that find support at this middle line.

- If the middle line is broken in a bullish direction, then we expect the price to increase to the upper level of the range.

- If the middle line is broken in a bearish direction, then we expect the price to decrease to the lower level of the range.

- If the price retraces to the middle line and bounces from this level, you can trade in the direction of the bounce until the price reaches the low/high of the range.

52-Week Range Middle Line

Above you see the daily chart of the Toronto Dominion Bank from February, 2014 through July, 2015. The image illustrates three 52-week time frames, which share the same high and low point (black circles). Each of the three 52-week ranges is marked with different colors – red, yellow and black. The 52-week high is located at $53.45 per share. The 52-week low stays at $39.57. To calculate the middle line you simply subtract the low from the high and divide by 2 (High – Low)/2.

(53.45 + 39.57)/2 = 46.51

For this reason, the middle line (blue) is located at $46.51 per share.

The first middle line signal comes when the price creates a real breakout through the blue level.

The breakout is bearish. Therefore, the signal is in a bearish direction.

As you see the price enters a sharp downtrend after breaking the middle line of the 52-Week Range indicator. Two months after the breakout through the middle line, the price reaches the lower level of the yearly range.

TD’s price then returns to the middle line at $46.51.

As you see, the blue level is tested as a resistance.

However, the price action does not succeed in breaking the middle line. As you see, the TD security gets sustained by the middle line and the price bounces in a bearish direction. This creates a signal on the chart that the price might return to the low level of the range again.

The price then enters a bearish trend. It takes the TD security a couple of months to reach the lower level of the 52-week range on the chart. When the price reaches the $39.57 level, then the target of the trade is completed.

Conclusion

- The 52-week range is 52-week high and 52-week low of the price.

- You measure the size of the 52-week range by subtracting the High from the Low: (High – Low).

- There are three techniques to use when trading with the 52-Week Range Indicator:

- Defining Trade Targets:

- Average Weekly Size: (High – Low) / 52

- Average Daily Size: (High – Low) / 252 {and not 365}

- Identifying 52-Week Range Breakouts:

- Look for nice round numbers to trade

- Remember to keep your stops tight

- Middle Line Breakouts:

- Build a line in the middle of the range. (High + Low) / 2

- When the price breaks the middle line, you expect the price to continue in the direction of the breakout until the range level is reached

- When the price bounces from the middle line, you expect a return to the range level

Day Trading Basics

Day Trading Basics