The morning reversal gap fill is another great trading setup for the first hour of trading. The ideal time to enter the setup is within the first 30 minutes of trading.

What is the Setup?

A stock gaps on the open, preferably 3% or greater. Remember, this gap can be either to the upside or the downside.

After the gap, the stock shows a potential reversal sign. This can come in the place of a candlestick or heavy volume event.

You then fade the action and go in the opposite direction of the gap with a profit target of the start of the gap.

Just to be clear, you are fading the gap. So, this is going to require some skill on your part and should not be a strategy you use if you are just starting in trading.

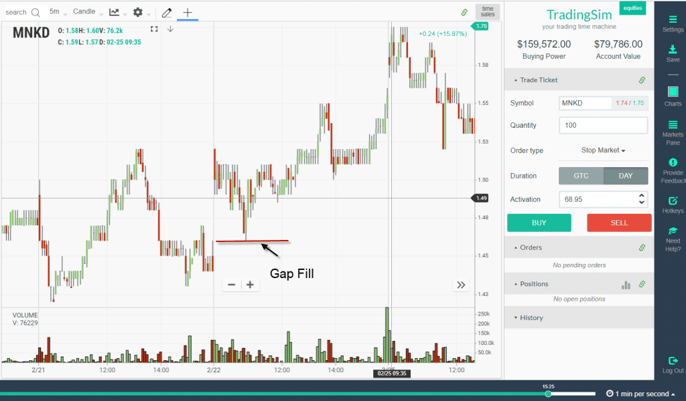

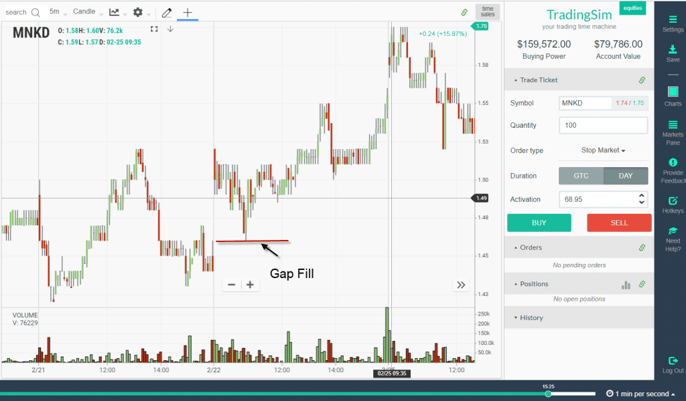

Chart Example of a Gap Fill

Gap Fill

In the above chart example, this is a penny stock with choppy action.

Notice how MNKD gapped higher on the open but quickly reversed course and filled the gap. After implementing the gap fill strategy, the stock never looked back and shot higher into the early lunch time frame.

I wanted to show an example where the play worked out, but notice how quickly the stock would have turned against you if you were short.

This is why honoring your stops and targets are paramount with this chart pattern.

Now that we have briefly described the setup let’s dive right into a few trading examples and how to protect your capital.

Intraday Gap Trading Strategies for Morning Reversal Fills

Trading a Gap Fill with a Slow Mover

The case below will show you how to trade a morning reversal gap fill when the equity is slowly trending.

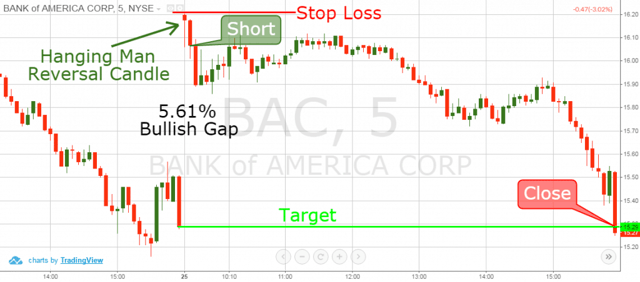

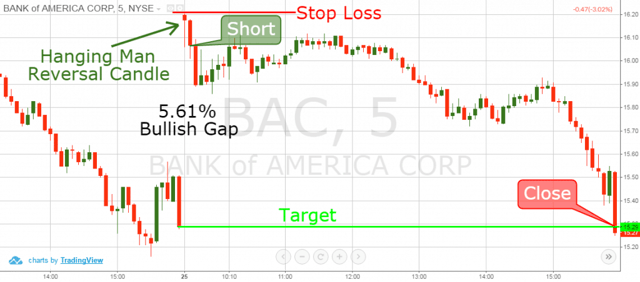

Morning Reversal Gap Fill

Above is a 5-minute chart of Bank of America. The stock opens with a 5.61% gap to the upside.

Short Entry

Notice that the first 5-minute candle after the gap is a hanging man reversal candlestick. This gives us a short trigger which we can use to fade the gap.

Well on the next candle, we short the low of the hanging man with an average price of $16.07.

Stop Placement

We put our stop loss right above the head of the hanging man candle pattern as shown in the image above. This means that we are risking .87% on the trade.

Profit Target

The profit target is the low of the candlestick preceding the gap. I went with that target because it’s a little further than the gap, but still above the swing low of $15.20.

Since BAC is a slow mover, you had to be patient in the trade.

It took all day, but BAC finally hits our target in the $15.30 area which gave us a profit per share of 77 cents. Remember our risk on the trade was approximately 14 cents.

This is a risk-reward ratio of 5.5, which is what you want to see for this type of setup.

When Should You Expect More From the Setup?

One thing I have yet to master but it can take your trading to the next level is knowing when to expect more from your chart setup.

In the previous example, we closed the trade out slightly beyond the gap fill. For you conservative traders out there like myself, you will want to close the trade out right at the gap.

Now, what about those reversals that lead to all day holds? The trades that gap up and just fail on the open. But they don’t just roll over a little; they make sure anyone holding a long position is just bludgeoned throughout the entire day.

It’s tough to see, and I hate to admit it, but early on in my trading career, I was the guy still holding on for the rally back to the high of the day.

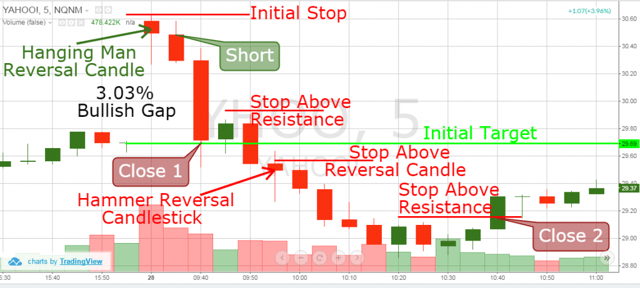

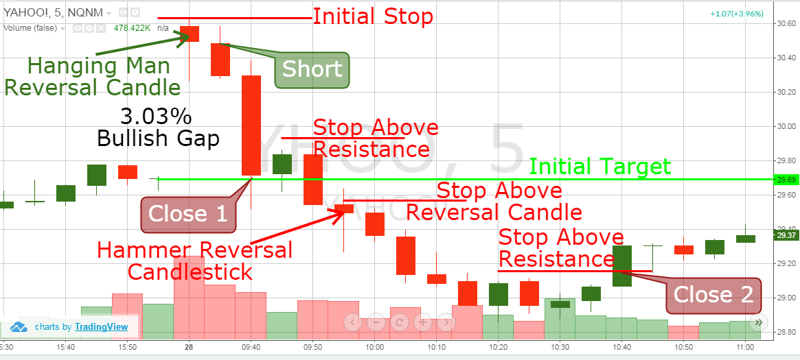

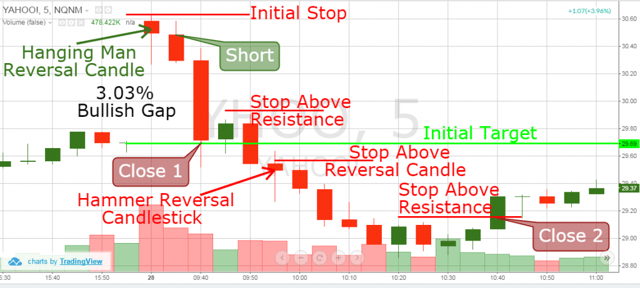

All Day Hold Example

In the chart below, notice how the stock fills the gap within 10 minutes of the open. Not only does it fill the gap quickly, but look at the size and volume of the candle.

When a stock goes in your favor quickly with little to no push back, these are the ones you want to possibly hold on for bigger profits.

Extended Target – Morning Reversal Gap Fill

Above you see the 5-minute chart of Yahoo.

Yahoo starts with a 3.03% bullish gap, followed by a hanging man reversal candle. This gives us a signal that the bullish gap could turn into a counter trade opportunity.

We short Yahoo and just like the Bank of America trade mentioned above; we place our stop-loss order right above the head of the hanging man. This stop represented a trade risk of .49%.

The next two candles are bearish and are relatively large. The second candlestick completes our morning reversal gap fill target (green horizontal line). At this point, you could close the trade, and it’s a winner with a profit of 2.5% on the trade.

This represents a 5 to 1 risk reward ratio.

Expanding Our Profit Target

Now that we figured we want to expand our profit target, we can’t just fire and forget. We need to continue to manage the trade. A simple method you can use is to look for bullish candles on the way down and to place your stops above the respective candle.

As the stock continues in your favor, you continually adjust your stop to lock in your profits.

The next candle in the row is bullish and small. We can use the area above that candle to adjust our stop.

In the Yahoo example, we use this exact stop strategy and follow the trade lower until Yahoo enters a trading range and ultimately breaks higher.

We close the trade at $29.16 per share. Remember our first target was $29.69, so this represents an additional 43 cents in profit.

Conclusion

- Morning Reversal Gap Fill represents a shift in the market momentum, which results in a direction change.

- When you trade Reversal Gap Fill, try spotting gaps between 3% and 10%.

- Do not attempt to trade really large gaps of high float stocks. These will often lead to flat ranges.

- Enter the market on a reversal candle after the gap.

- Always put a stop loss above the reversal candle on a bullish gap and below the reversal candle on a bearish gap.

- Make sure your risk-to-reward ratio makes sense. In this article, we displayed ratios of 5 to 1.

- If the stock moves quickly in your favor, you can opt for more gains, but remember to trail your stops.

How Can TradingSim Help?

The biggest thing about this pattern is ensuring you get enough reps in to see which gaps will fill, versus the ones that will turn and go against you.

This is where Tradingsim can help by allowing you to quickly scan the market for morning gaps so that you can practice fading the setup.

To learn more about this gap fill strategy setup, please check out this cool video from YouTube. You can also use these strategies and test them out in TradingSim as well.

Futures Trading Strategies

Futures Trading Strategies