If you're getting into the crypto world and are looking to make some good money, day trading could be a great avenue. Sure, people who get in early (meaning really really early) and hold on to their positions on Bitcoin made a lot of money. But day traders, who buy and sell in rapid succession throughout the day, could be better suited during market downturns and high volatility.

In this article, we'll cover all the basics of day trading crypto and bitcoin in detail: what it is, how it works, and how to do it successfully.

What is day trading crypto?

Day trading crypto can be a lucrative way to make money, but it's also risky. With day trading, you're speculating on the price of a currency, and you're buying and selling that currency throughout the day in an attempt to make a profit. By definition, a day trade is the purchase and sale of any asset within a single day -- no overnight holds.

Because the prices of cryptocurrencies can fluctuate so rapidly, day trading crypto can be very profitable if you time your trade correctly. However, it's also very easy to lose money day trading crypto if the market moves against you. Risk management and position sizing become paramount in the world of day trading if you are to be successful at it.

Day traders will use technical analysis to determine when it's best to buy or sell their assets based on where they think the price will be in the future. Most decisions in day trading are made purely on price and volume analysis, technical indicators, and support and resistance levels.

Day trading is often done by buying and selling assets using margin. You can also day trade outside of margin, but this means you must have enough money in your account to cover potential losses without being able to borrow money from an exchange.

How does day trading bitcoin work?

Day trading bitcoin is basically the same as day trading stocks, except it's done with cryptocurrencies. The entire process of buying and selling cryptocurrencies all within the same day is called "day trading" because you're trying to make profits from buying and selling short-term price fluctuations within a single day.

In order to understand how this works, let's take an example:

You want to day trade bitcoin because you think its price will go up over the course of a few hours, so you buy some bitcoin at $15,000 USD per coin. You then sell your bitcoin at $16,000 USD per coin later that same day (you can set your own time limit or price targets).

Given the price reaches your target, you've made a profit of $1,000 USD. If we break down all aspects of this transaction further, it would look like this:

- Buy 1 BTC at 15k USD = 15k * 1 = 15k USD spent on purchase

- Sell 1 BTC at 16k USD = 16k * 1 = 16k spent on sale

- Gross Profit = 1k USD

- Exchange fee = 1.5% (15 USD)

- Net Profit before taxes = 985 USD

Now, this all sounds well and good, and perhaps easy, but it isn't. As with any trading strategy, long-term or short-term, you will have to employ a sound set of rules, criteria, and edge for discovering a profitable trade idea. This comes with time, observation, and analytics.

So, don't assume it's as easy as 1-2-3.

Can you buy and sell crypto on the same day?

Yes, you can. Depending on the brokerage you choose, there are ways to buy and sell crypto or bitcoin on the same day. However, if you're looking to day trade with crypto, there are a few things you need to know.

First of all, it's important to understand that day trading requires you to take advantage of short-term price movements in the market. This means that you'll need to have a strong understanding of technical analysis in order to be successful. Often, intraday trading activity can be very choppy. Unless you are experienced in this type of trading environment, you might want to stay within a crypto simulator until you feel confident in your strategy.

Additionally, you'll need to be comfortable with the volatility of the crypto markets. Day trading can be a profitable way to make money from crypto, but it's also risky. Large price fluctuations can happen at a moment's notice. In order to prevent catastrophic losses, we recommend that you choose a dynamic broker that allows for stop-losses and other risk management tools to mitigate your drawdowns.

So, make sure you do your research and only trade with money that you can afford to lose.

How much money do you need to day trade crypto?

If you want to day trade crypto, you'll obviously need to have some money set aside for it. How much you need will depend on the coins you're trading and the exchanges you're using.

In any case, let’s assume that to day trade cryptocurrencies, you need to start with a minimum of $500. It may seem like a small amount of money, but it should be enough to get started and test the waters with most brokerages. In fact, nowadays many brokerages offer fractional shares that allow you to trade assets like Bitcoin in small amounts.

This amount of money will give you enough room to buy and sell without incurring too much in fees and ensure good money management strategies. Of course, if you're trading altcoins, you'll need to have a bit more since they're not as widely traded as bitcoin (which means that with low volumes you might be stuck in a position longer than expected).

All in all, though, you don't need a ton of money nor do you want to start with a ton of money to day-trade crypto. Be sure to start small and increase your size as you get more comfortable with the market and can prove to yourself that you can be consistently profitable over time.

Automated crypto trading apps

If you would rather not have all the responsibility that comes with money management and actively participating in the market, there is always the option of using a day trading robot that will do most of your work for you. You can find them online or on apps such as Google Play or Apple Store.

However, if you are using one of these robo-traders, please, remember to keep your eyes open and aware of the reliability of the intermediary you are choosing. In general, we don't recommend these systems as we do not know the trustworthiness of the software or the algorithmic strategies they employ.

You might be better off designing your own through proper research and development.

To start day trade crypto you just need to choose a single strategy that works best for your needs and stick with it until profits are made.

Which crypto is best for day trading?

There are many different cryptocurrencies available for day trading, but Bitcoin is often considered to be the best option. Bitcoin is the most liquid cryptocurrency, with a large market cap and high trading volume. This means that there is always a buyer or seller available, and prices can change rapidly in response to news and events.

Given that the best cryptocurrency to day-trade is Bitcoin since it’s the most liquid and popular currency, you're most likely to find an active market for it. Bitcoin is also the most widely known and accepted cryptocurrency, making it easy to buy and sell on exchanges. For day traders, Bitcoin offers an opportunity to make quick profits on small price movements.

However, it is also important to be aware of the risks associated with day trading Bitcoin. The price of Bitcoin is highly volatile, and sudden changes can lead to losses. As such, day traders must carefully monitor the market and be prepared to exit trades quickly if necessary.

If you want to trade other cryptocurrencies, it's a good idea to use an exchange that offers in-house markets for multiple coins (like Coinbase). That way you can easily buy and sell the coins of your choice without having to jump through hoops or sign up for another cryptocurrency exchange.

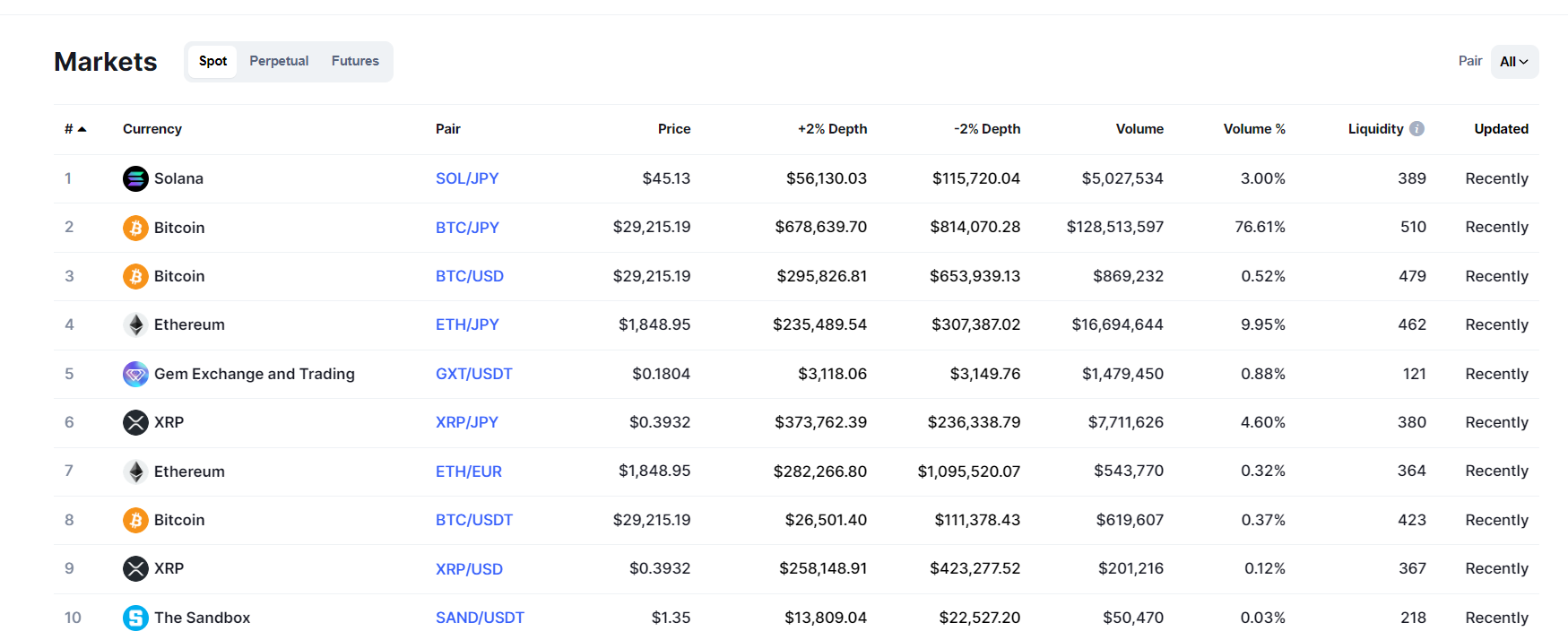

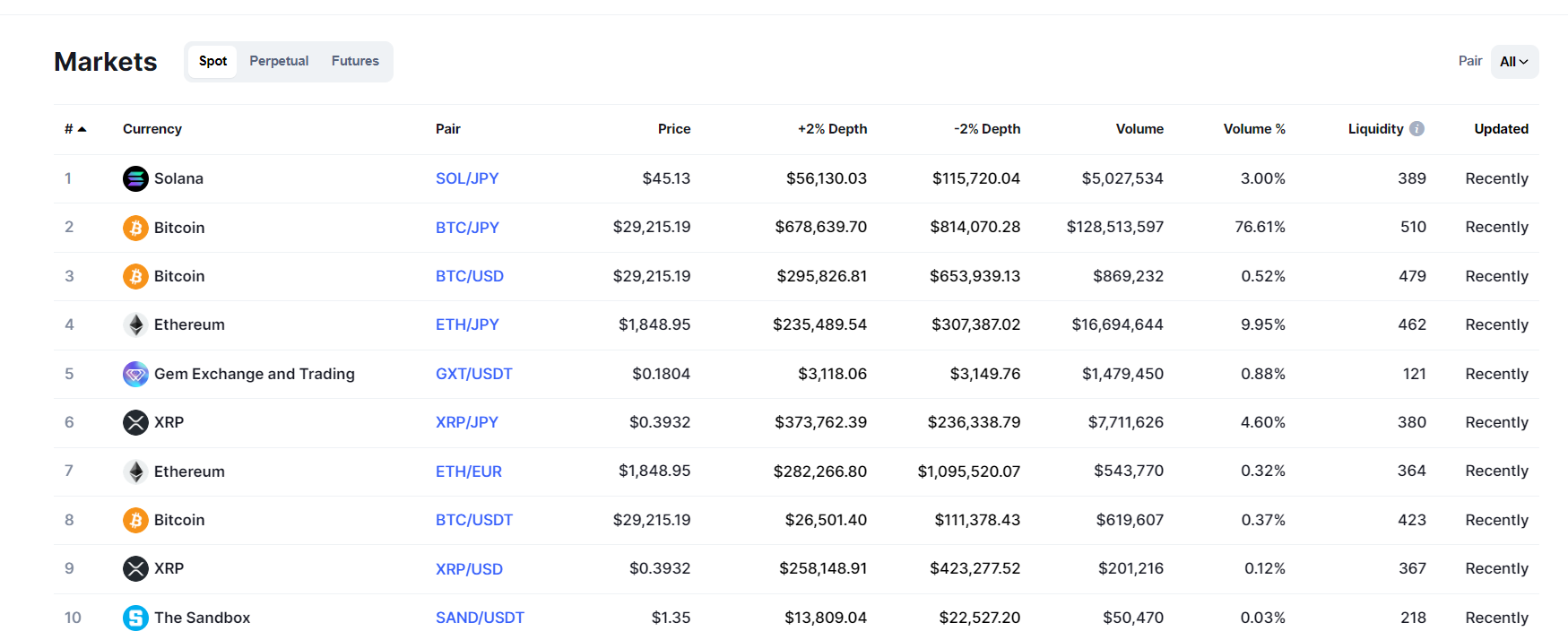

Lastly, if you want to find the cryptocurrencies with the highest liquidity, you can do some research at CoinMarketCap in order to find other assets to trade besides Bitcoin. At the time of writing here are some of the more liquid and tradeable names in crypto:

Where can you day trade crypto?

As a beginner, you may be wondering where you can day trade crypto. There are many options to choose from, but the first thing to keep in mind is that not all exchanges will allow you to day trade cryptocurrencies. In fact, some only allow users to place buy or sell orders for a certain amount of time before they expire. It might be best for your first experience with cryptocurrency trading to stick with an exchange that allows limit orders as well as market orders (and even stop losses).

The second thing to keep in mind is that not all brokers will have the same features on their platforms, and they may have different rules regarding what type of trades they allow.

For example, some brokers require clients to stay under a threshold of exchanges made per day or to perform all legal compliance tasks before their broker account allows them access to its trading platform. You may need to investigate which platform fits best your needs.

As a quick overview, here is a list of the best, or most popular, day trading crypto platforms:

- Bitstamp

- Okcoin

- Gemini

- Crypto.com

- Coinbase

- Webull

- Binance

- Robinhood

- FTX

Each one of these will have its advantages or disadvantages and we don't recommend one over the other. In fact, some of these brokerages will allow you to trade only a handful of cryptocurrencies, while others have a long list of coins. Some give you ownership of the underlying asset, while others are more derivative-based and simply allow you to profit off the transaction while not actually "possessing" any coins during the transaction.

How many times can you day trade crypto on Robinhood?

You can day trade crypto on Robinhood as many times as you want. In fact, there’s no limit to the number of trades that a user can make in a day or week, but just a limit of the number of coins that are open to day-trading activities. Unlike the rules regarding pattern day trading and day trading stocks, cryptocurrencies are not limited by the same regulations. In other words, you don't need $25k to day trade crypto on Robinhood.

We should mention that in the past the popular investing app Robinhood has experienced periods of high volatility that led to crashes and outages. This caused frustration for many users, as it made it difficult or impossible to place trades. This is not limited to Robinhood, however, as any exchange can experience such software glitches.

In order to comply with new regulations, Robinhood has implemented measures that restrict trading during periods of high volatility. This may cause some inconvenience in the short term, but the company "assures" it's ultimately in the best interests of both the company and its users.

So if you're planning on trading during a volatile period, be aware that there's a remote chance the app may crash or restrict your trading.

How many times can you trade crypto in a day?

Day trading Bitcoin can be a great way to make money, but it's important to know how many times you can trade in a day. In brief, there is no limit on how many times you can trade crypto in a day, it depends on your account and the exchange. Basically, you might be able to trade as many times as you want and 24/7.

However, it is worth noting that more trades do not always equate to more money. More often than not, fewer trades result in more long-term success in the market.

For this reason, it's always a good idea to do your research and practice with a demo account before putting any real money on the line. Day trading can be a great way to make money, but only if you're careful and know what you're doing. With a little research and practice, you can learn how to day trade bitcoin like a pro.

Is day trading crypto profitable?

Yes and no. If you are willing to practice in a simulator and have the patience to wait for the right opportunity to make a move, then it's possible to day trade crypto and make some pretty good money. But like any trading endeavor, it requires that you treat it like a business and manage your risk properly.

It's important to note that there's no way of knowing how much money someone will make until they start trading (or at least try). But if we look at historical data from similar markets (like stocks or oil), we can see that this type of investment can be very profitable over time.

Cryptocurrencies are still in their infancy as an asset class, so there isn't much data about them yet—but what we do know suggests that investing in cryptocurrencies has been a pretty good idea so far: since 2009 when Bitcoin was first introduced, its price has increased more than 1 million times its original value. That's if you have diamond hands and were an early investor.

Day trading is a different story. It requires a different set of tools and discipline in order to profit off of short-term moves. If you haven't already, check out our post with some thought-provoking questions on whether or not you have what it takes to be successful at day trading.

How do I start day trading crypto?

The first thing you need to do is to educate yourself. Not only do you need to know about what an exchange is and how to buy crypto, but you need to learn about trading strategies, trading indicators, and risk management techniques.

The second thing you need to do is practice strategies in a simulated environment like TradingSim which allows you to track your progress and analyze your trading results. Over time, you'll want to critique your stats for each strategy that you use and determine if you have the ability to trade with real money.

Once you are confident in your strategies, you can create your account on an exchange like Coinbase or Binance, or any of the other leading exchanges. Once you’re set up with an account, you may want to look into a crypto wallet.

There are plenty of options out there, from hot wallets to cold wallets. In comparison to fiat money (such as USD or EUR) wallets are a means for securing your money similar to keeping it in a bank.

Cold wallets are the safest method to store your coin but are less accessible to perform day trades, while hot wallets such as Metamask are easier to access and less secure.

You also have a third option which is leaving the money on the exchange you want to use to do day trading. For most active traders, this will likely be the best choice

So, you created your account on an exchange, and you made a bank transfer to fund your account. Now the market is at your fingertips. It's as easy as picking the crypto you want, analyzing the charts, and trying to predict price movements in order to start day trading crypto.

Conclusion

You don't have to be a millionaire to access the cryptocurrency market and make money with it. There are several ways in which you can start trading with little money. In fact, we recommend that start small.

The key is to educate yourself on what opportunities exist and where your best chances for success lie. Become a student of technical analysis and train yourself in a simulator before risking your hard-earned cash.

Making day-trading crypto your main source of income will not be easy, but you can get there with loads of practice and commitment.

Day Trading Money Management

Day Trading Money Management