Automated Day Trading Definition

Automated Day Trading Definition

Automated day trading is probably one of the most interesting aspects of day trading. It often brings awe and mystery to it. This is partly because of the fact that terms such as algo-trading, high frequency trading and so on are widely used in the mainstream media.

In reality, there is nothing awe-inspiring about automated trading. It is after all, just a simple program that makes decisions based on the conditions defined. Of course, in some cases, automated day trading programs can be a lot more sophisticated.

But no matter how complex an automated day trading program is, the basic framework remains the same.

There are many types of automated day trading strategies or algorithms. Traders can build an automated day trading program based on either the already available technical indicators or based on customized indicators and tools.

Some complex algorithms go as far as looking at other markets, reading the news and searching for specific words in order to execute trades.

1 – Why do traders and institutions use automated day trading?

There are quite a few advantages with automated day trading. The most important being that trading is more rule based and this removes the role of emotions. Emotions are probably one of the biggest challenges for day traders.

One winning trade after another can often build up a confidence in a trader. This can lead to complacency. Every now and then, the market goes through a shake up and even the strong positions fall.

Likewise, in a losing streak, the emotions can make you take illogical decisions or impulsive decisions. Moments like these lead to misusing of funds, ignoring the risk management strategies and so on.

While emotions are quite an obstacle for day traders, with enough practice and discipline, one can overcome these. However, some traders prefer to make use of automated strategies, not just because they want to trade without emotions, but also for a number of other reasons.

For example, some day traders prefer to take a few trades before the get back into their routine. Chart watching can be a luxury for some, not for many. In such instances, automated day trading strategies can help.

On the institutional side, such as large banks and financial institutions, automated trading is a big business. Companies such as Goldman Sachs employ people known as quants and pour a lot of money into research and development.

Also known as quants, the job requires people to analyze the markets and build models that can automatically trade the markets.

2 – Should day traders use automated trading?

The answer to this is very subjective, so it is a yes and a no.

Some traders prefer a manual approach to trading. To be successful at this, one needs to be patient and more importantly learn how to control their trading emotions.

Still, there are also full time traders who prefer to use automated day trading strategies. The reasons behind this could be many.

At the end of the day, it is up to the day trader to decide whether they want to make use of automated day trading strategies instead of manually trading. In most cases, traders look to automated day trading when they feel that they have a winning strategy that can be automated.

After all, we make use of macros in MS excel, small programs that can do repetitive tasks. So is the role of automated trading as well.

There are many ways to build automated trading strategies. You can either customize a trading strategy by yourself and have a programmer code it, or you can buy an automated trading system off the shelf, like a black box system.

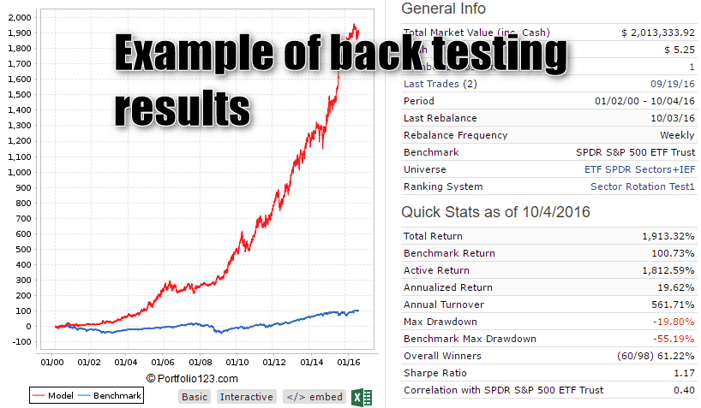

No matter which of the two approaches taken, day traders should realize that the automated trading strategy needs to be thoroughly back-tested and forwarded tested to see if it can really make money in the markets.

3 – Things to avoid when looking at automated trading systems

Most of the times and especially when you look at the off-the-shelf automated trading systems, one needs to be very careful.

It is very easy to change the parameters of a trading strategy so that it shows that it is profitable. This is often referred to as curve-fitting. At times this can be intentional and at times it can be a genuine mistake.

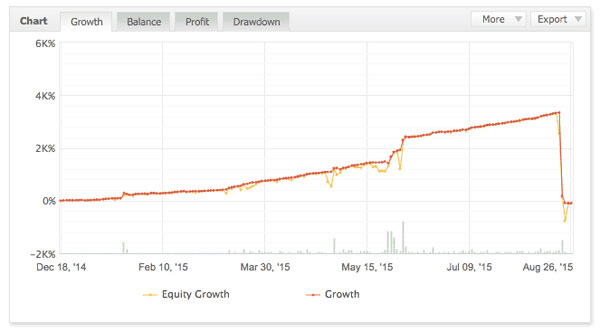

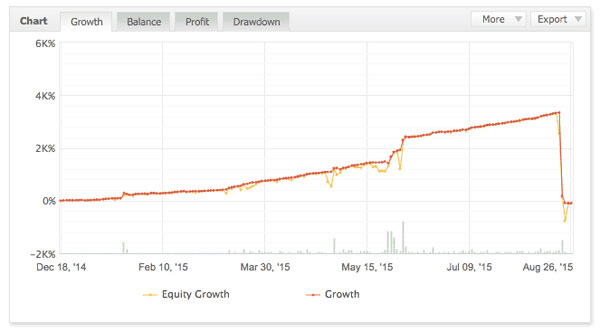

Curve fitting an automated trading strategy

In an effort to build the best automated trading strategy, day traders and developers end up tweaking the trading system to an extent that it looks good when back-tested but not so great results when forward tested.

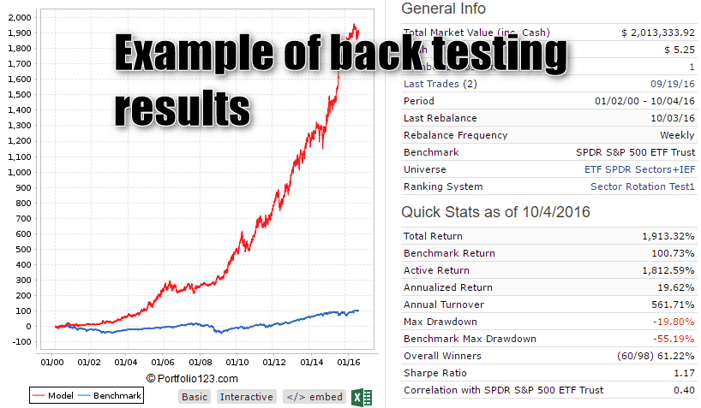

Example of back testing results used for testing an automated trading strategy

Therefore, it is important for day traders to understand that what might seem like a good trading system could perhaps be simply curve-fitted in order to make more sales.

Of course, the best way to make use of automated trading is by customizing a trading strategy all by yourself. This way, you are able to take a look at the trading system and understand how it works, rather than curve-fit and set yourself up for losses.

4 – What are the pros and cons of automated trading?

As with everything, there are clearly pros and cons with automated trading systems. However, the most important aspect of automated day trading is in knowing when to use it and how to use it. For the most part, day traders often use an automated trading strategy and apply it to different markets or on different times frames.

This is done in hopes to get the most out of the automated day trading system. While the intentions might be apparent, this is a rather wrong approach. In some cases, the automated day trading system can actually trigger false trades. This happens during choppy or volatile market conditions.

It is however apparent that there are some clear advantages and disadvantages of automated day trading systems. The pros and cons are listed below.

5 – Pros of Automated Day Trading

Only a small amount of day traders can actually manage their emotions well when it comes to the markets. Honing these skills takes time and for most traders in this case, an automated day trading system can help to remove the emotions out of the picture.

Day trading also requires a bit of time and dedication. This means, day traders need to constantly keep looking into risk, their trade management, entries and exits. This can take up a lot of time and honestly, not many can manage this. An automated day trading system can help traders to manage these aspects in a better way.

Chart watching, as mentioned earlier is a luxury that not many can afford. If you are day trading, chances are that you are actively trading and focusing on a particular time frame. This means that day traders will need to constantly keep an eye, not just on the charts but also a number of instruments. This can get tedious at one point.

Automated day trading strategies can help in such cases especially if there are no complex rules involved. For example, with automated day trading one can simply build a program that will trade when there is a moving average crossover and book profits and manage trades accordingly.

This completely eliminates the need for human intervention. Depending on the complexity, the code can also be further customized to scan only specific assets or instruments. Further additions such as risk management, trade management and so on can be made as well.

6 – Cons of Automated Day Trading

The downside of using automated day trading strategies is that the markets are never really in a constant flow.

Price always reacts to unfolding developments and therefore it is quite possible that the automated day trading system can trigger false trades. There are times when human intervention is required and this is where an automated day trading strategy falls short.

There are numerous cases of trading algorithms going rogue. One of the most famous examples is the incident with the trading firm Knight Capital Group.

In a matter of just 30 minutes on August 1, 2012 the company lost over $440 million. This was because of the automated day trading software that went berserk due to the market conditions. This simple mistake put the company on the verge of going bankrupt as a result.

Another famous example of automated trading systems going rogue is the famous flash crash of the markets on May 6, 2010. The market crashed for approximately 36 minutes as the major indices fell sharply. The Dow Jones witnessed the sharpest intraday declines on the day, losing 9%.

May 6th 2010, ES Futures Flash Crash

However, just a while later, the markets recovered back strongly.

Upon further investigation, it was revealed that the flash crash was a result of a trader, Navinder Singh using spoofing algorithms. Singh placed a number of false orders in the E-mini S&P500 futures market.

Spoofing, in lay man terms is nothing but fooling other market participants into buying. This leads to a strong rise in price of the asset. When this happens, the trader who initiated the false orders is at an advantage as they know that other traders are buying.

They can either buy into the frenzy or simply wait for a good price to start selling.

The above two examples show how automated trading can be used in different ways.

While in the case of Knight Capital Group, it was a genuine mistake of the algorithm, while in the case of Singh, it was an intentional attempt to fool the market with the spoofing algorithm.

In the second case, such intentional use of automated trading systems can actually wreak havoc with regular day traders, or manual day traders.

7 – Popular automated day trading systems

If you are considering using an automated day trading system then it is rather best to start with the very simple to gain experience before looking into complex automated trading strategies.

Remember that each automated day trading system is in most cases is tweaked to a certain market and a certain trading style. While it might be tempting to use it in different markets, the fact is that it may or may not work. In some cases, you will also have to customize the automated trading system a bit differently too.

To have a good automated trading system, ensure that the trading strategy that you follow now is mechanical, without any discretion involved. Most commonly, breakout trading based automated systems are the best as these can be configured quite easily.

The automated day trading system can also take into account the trading session including limiting trading to just the opening or at the close (when the volumes are high). A lot more configurations can also be done and it is entirely up to the day trader on how they want to fine tune the trading system.

No matter what automated trading system you use, it is essential that the system is first thoroughly backtested on a demo trading environment. This will keep you from losing money. It is also important to test the system under different market conditions.

In this case, forward testing is ideal.

The question as to how long to forward test a trading strategy is up to the trader. In some cases, your automated day trading system could instantly start losing you money only to recover from the drawdown later. Thus, writing off the automated trading strategy in the first instance can be detrimental.

In conclusion, automated day trading is a part and parcel of day trading. Manual traders don’t really like the automation, but there are numerous studies that show how automated trading such as high frequency trading and so on can help bring more liquidity to the markets. The flipside is the fact that volatility also increases sharply on account of the automated trading systems.

While there is no compulsion that a day trader must look to an automated trading strategy, it is a matter of personal choice on whether one should use an automated trading system or not. Day trading is unique from one trader to another, and therefore the choice of whether or not to use an automated trading system depends entirely on the day trader themselves.

Trading Strategies

Trading Strategies