ADX Overview

The ADX (Average Directional Index) is a creation from technical analysis legend J. Welles Wilder. It’s clear that Wilder was attempting to do two things with the ADX indicator:

- inform a trader when the market is trending

- filter out counter-trend trades to keep you on the right side of the market

As I perused articles on ADX across the web it was clear there was an information gap. Most articles hit on the two areas I just mentioned, but none managed to see the bigger picture.

That is the ADX is a part of a suite of indicators created by Welles to analyze the market.

In this article, we will briefly touch upon the background for the ADX indicator, but we will quickly shift our attention towards using ADX with other Welles indicators to assess if we are able to define an edge.

Contents

Chapter 1: ADX Components

The ADX is comprised of the following components:

- Plus Directional Movement Index (DI+)

- Minus Directional Movement Index (DI-)

- ADX line

It kind of throws you a little right? You would expect to only see the ADX line, but the ADX itself is the smoothed average of the difference of the DI+ and DI-.

So then how are the DI- and DI+ lines calculated?

Well, that my friends has been well documented across the internet, and unless you are a quant, you should really spend your time learning how to interpret the indicator and abandon manual calculations.

However, if you really want to go deep, you can read more about how to calculate the indicator here on Wikipedia.

Now a couple of points to highlight, the ADX cannot have a negative value. So, it’s not like other oscillators that may fluctuate above and below a zero line.

The ADX is relative to its own price. Therefore a 50 reading in IBM is nowhere near as volatile as a 50 reading in Bitcoin futures.

This is a key point to remember, because price moves can vary wildly between securities and you do not want to apply a specific trading methodology, only to realize your security of choice was not a good fit.

Chapter 2: How to Interpret the ADX

ADX – Technical Indicator

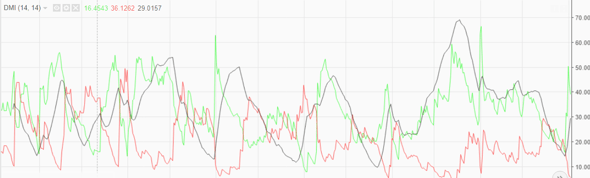

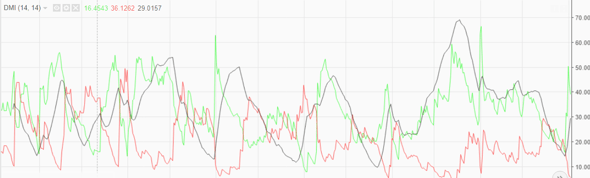

The above chart it the visualization of the ADX calculation:

- Green Line = DM+

- Red Line = DM-

- Black Line = ADX

At first glance, the ADX is a bit alarming with the up and down movements and unsmoothed nature of each line.

Do not let the image intimidate you. Taking things back to what we previously discussed, the ADX is here to do two things: (1) determine trend direction and (2) strength of the trend.

Determining Trend Direction

If the DM+ is above the DI- the security is in an uptrend. Conversely, if the DM- is above the DI+ the security is in a downtrend.

Pretty simple right? Well, not quite.

As you may have read in other articles, having constant exposure to the market is the fastest way to give away gains during choppy periods. Not that buy/sell signals from your favorite indicator are wrong, but rather the small gains are eaten alive by trading commissions and slippage on each trade.

This is where the next topic comes in handy.

Strength of Trend

Welles realized that the DM lines are in constant motion and will provide signal after signal. This is where the ADX line itself plays a critical role.

The ADX allows you to measure the strength of trend. Wilder instructed readings above 25 are trending markets and readings below 20 are choppy or sideways markets.

This of course is completely your call on what ADX reading will trigger you to trade.

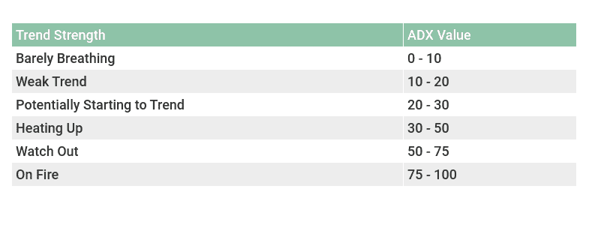

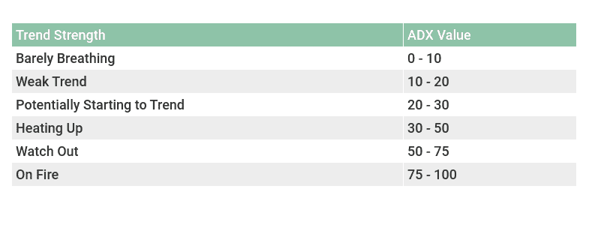

Below are general guidelines for how to interpret the trend.

adx trend strength

Chapter 3: Trading with the ADX

So, how do we go from understanding the makeup of the indicator to actually placing trades?

This is a tricky question to some degree.

Some sites suggest you can buy on a DM+ cross of the DM- and when the ADX is above 25.

This to me sounds a bit too casual and lacks imagination.

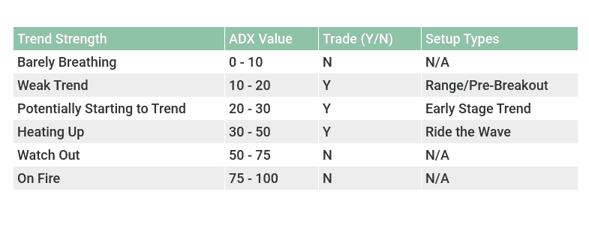

First, we need to determine what do with each ADX range we encounter.

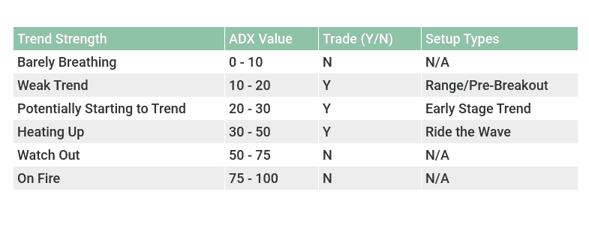

Setup Types

adx setup types

You will notice that I have listed three ADX areas as not applicable.

I think of the market in terms of a bell curve. Some traders make the most of the money on the extremes.

Those extremes can be times of low and high volatility.

I, however, like to trade in the center, where there is volatility, but not so much that analysis of any form plays second fiddle to market hysteria.

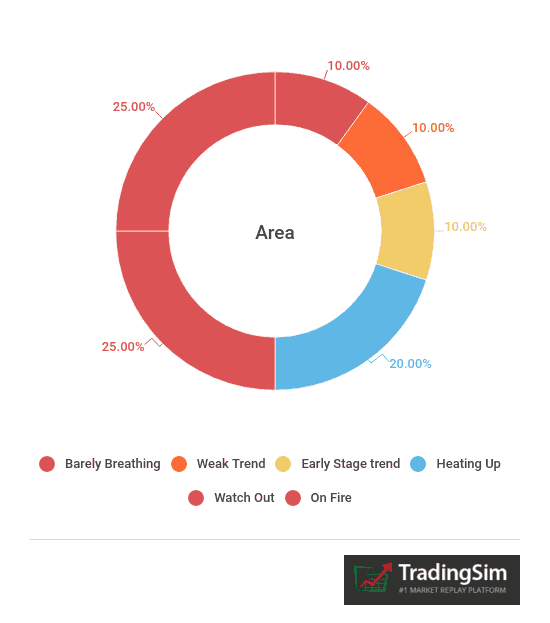

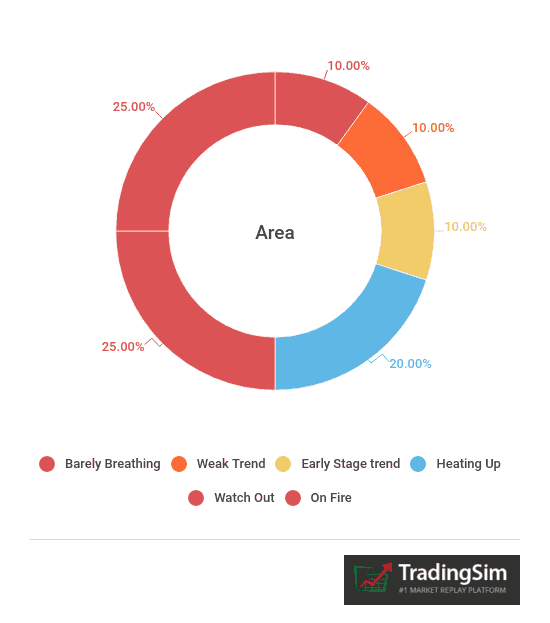

The below chart illustrates ADX values where trading can become frustrating – red coloring.

As you can see, this is more than 50% of possible readings on the ADX. These percentages do not represent the possible number of occurrences, but again how many ADX zones between 0 to 100 that are riskier to trade.

Types of ADX Setups

Find the ADX Value that Works for You

One thing I want to be absolutely clear about before we go deeper; not Wilder nor Al can dictate to you what ADX readings are suitable for your trading style.

If you like to scalp small moves, then a 0 to 10 reading could be perfect for you.

If you are into biotech penny stocks that fly up and down, 75 to 100 occurrences could be your sweet spot. I do not want to give you the impression I am flip-flopping, I just want to be clear the numbers detailed in this article work for me, but are not absolute rules.

You will need to test and learn to see which numbers work best for your trading style.

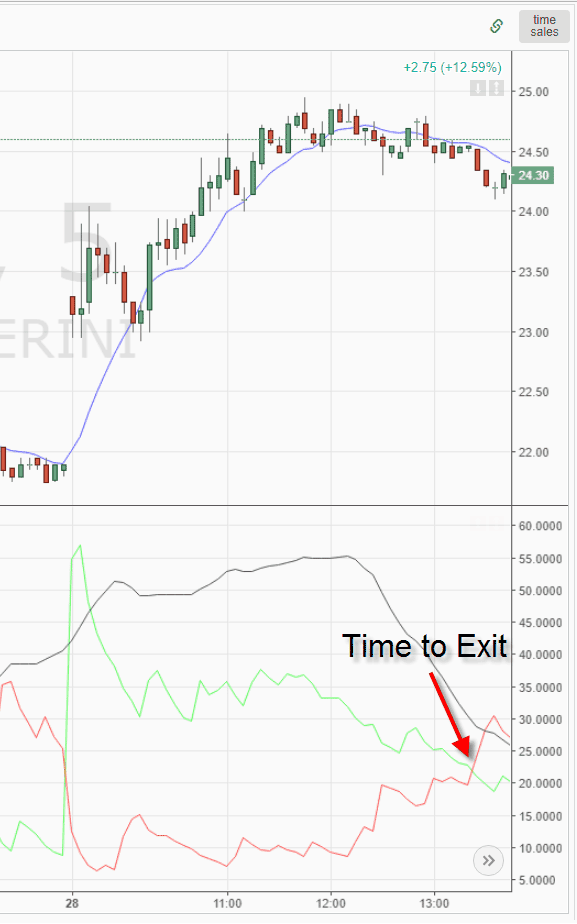

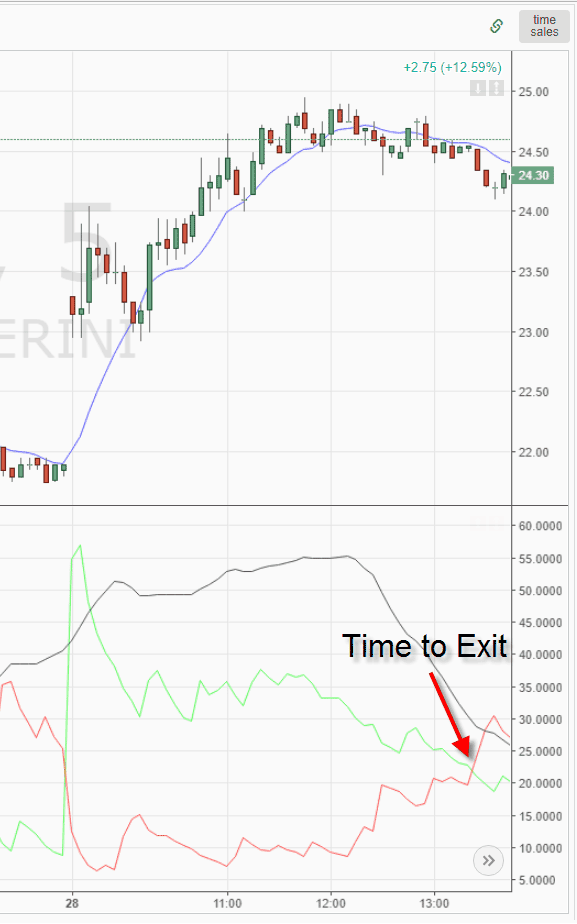

Crossover Setup

Buy on Cross

If you look on the web, this is the standard setup you will find. The ADX is above 25, and the green or red line cross one another. This will trigger an open order and since the ADX is trending, you will avoid getting into a whipsaw situation.

In this ADX indicator strategy, you hold the position until the green line or DM+ crosses beneath the DM- line.

Time to Exit

This looks so simple to trade. However, this is far from how things will play out on average. Remember, even the best traders are right only 75% of the time.

Let’s review an example that’s not so rosy.

Whipsaw

This is an image of the same security which had just provided you an awesome return on your long trade. Notice how the ADX is still above 20, which implies a trending move.

But instead of trending, the stock enters a sideways trading pattern, which would have you wasting time and money.

Some of you may say, well I can just raise the required ADX value to avoid the noise, but that’s not the answer. The market could give you the same buy and sell orders in a range with a higher ADX value.

Remember, the market is random at best, so you have to accept these occurrences – they are unavoidable. This is where having proper profit to loss targets will result in a positive return by month-end.

Trading the Ranges

ADX traders will subscribe to some threshold of when not to trade with the indicator. This is most likely when the ADX is at the lower end of the spectrum. While I myself avoid values below 10, that doesn’t mean there isn’t money to be made in the trenches.

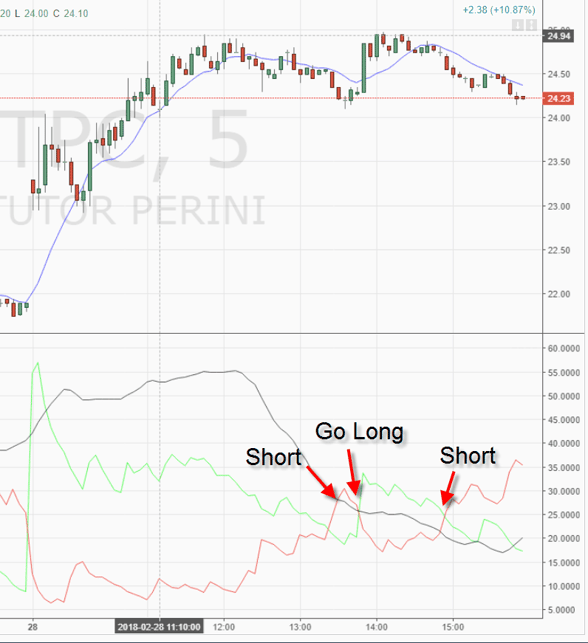

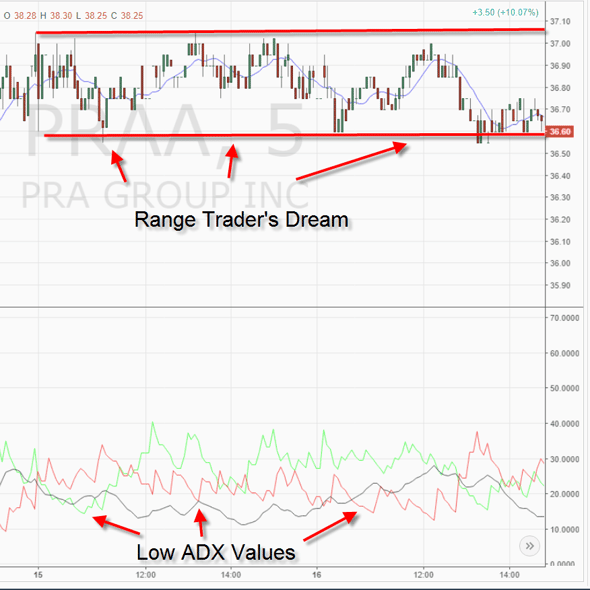

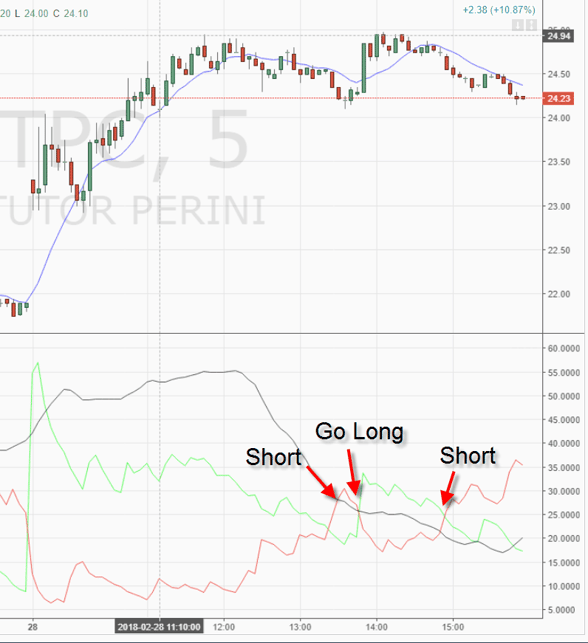

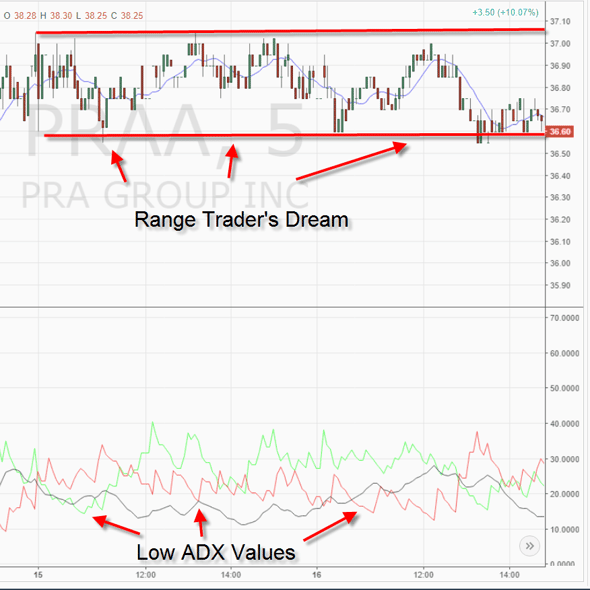

Range Trader’s Dream

This chart displays an ADX value that is below 20, yet the stock was in a tight range, which is perfect for range traders.

So, are these bad trades because the ADX is not trending?

You can start to see as a standalone indicator, the ADX is displaying a few issues.

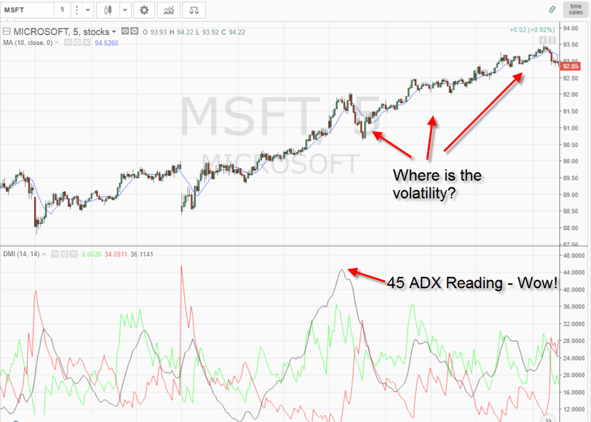

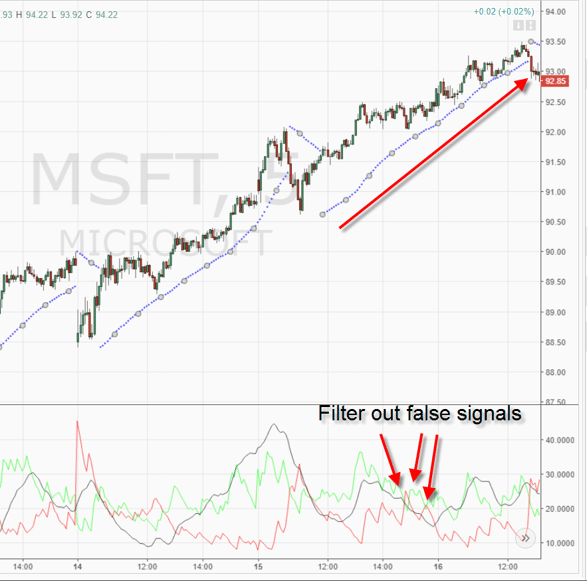

All Extreme ADX Readings Are Not Created Equal

I started this earlier in the article, but it was likely overlooked, so let me reinforce this point.

ADX ratings are relative to the security you are trading. Therefore, my high volatility traders should not get overly excited every time they see a 50 ADX value.

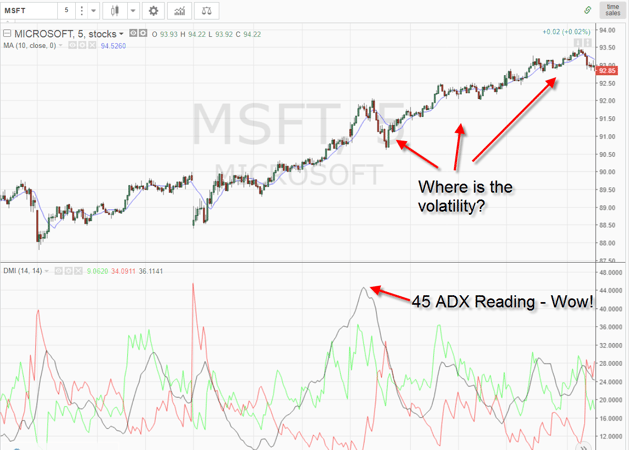

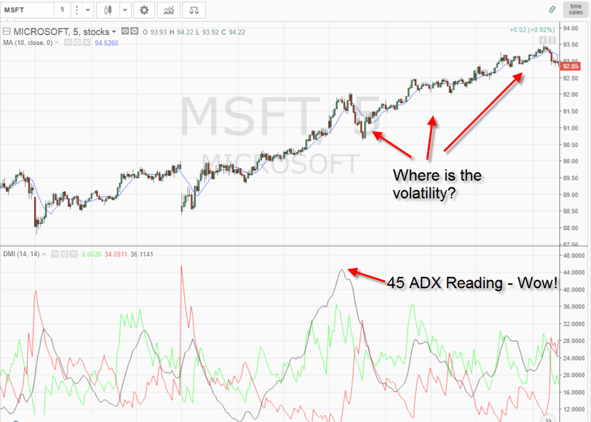

Where is the Volatility

If you just look at the candlesticks and trend without price, you would surely think this was a home run trade.

As you can see, the ADX peaked near 45.

However, this is a chart of Microsoft, which historically has low volatility. Therefore, if you were hoping to get an 8% swing, the odds of this are slim to none.

Therefore, know the ADX value, but more importantly, understand how your security trades and if the price action aligns with your ADX trading strategy.

Combining ADX with Other Wilder Indicators

I believe you need to combine the other Wilder indicators to really put together a full ADX trading strategy based on volatility. Wilder’s most popular indicators are the ADX, RSI, Average True Range (ATR), and the Parabolic SAR.

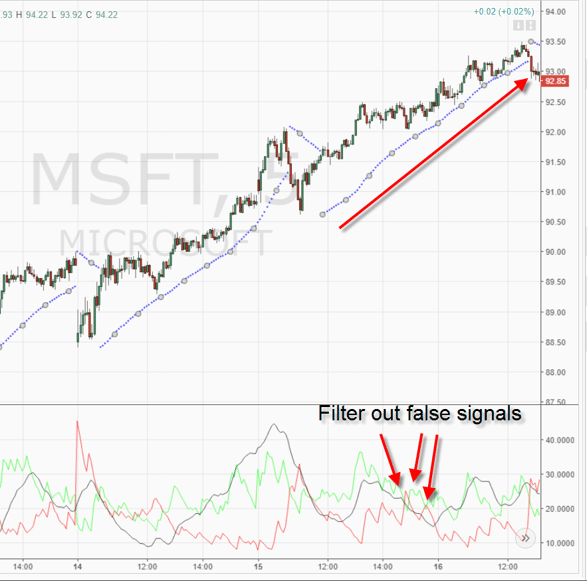

Parabolic SAR

So far in this article, we have leveraged the DM lines to determine where to exit trades.

Well, what would happen if we combined the Parabolic SAR (Stop-and-Reversal) as a way for exiting trades. To go deeper into what is a Parabolic SAR, you can visit the following article here at TradingSim.

Now, back to the charts.

I like to use a slightly smaller increment on the Parabolic SAR of .002 to reduce the amount of noise rather than the standard .02.

Parabolic SAR

Now one could argue that you could increase the length of the ADX to achieve the same results; however, the Parabolic SAR reacts faster to recent price movements which makes it a great tool for managing opening positions.

Look at your most recent trades and see how exiting with the Parabolic SAR compares with exiting based on DM line crosses.

Relative Strength Index (RSI)

The RSI is a great oscillator for measuring strength. Now when it comes to combining the indicator with its cousin the ADX; I am not a fan.

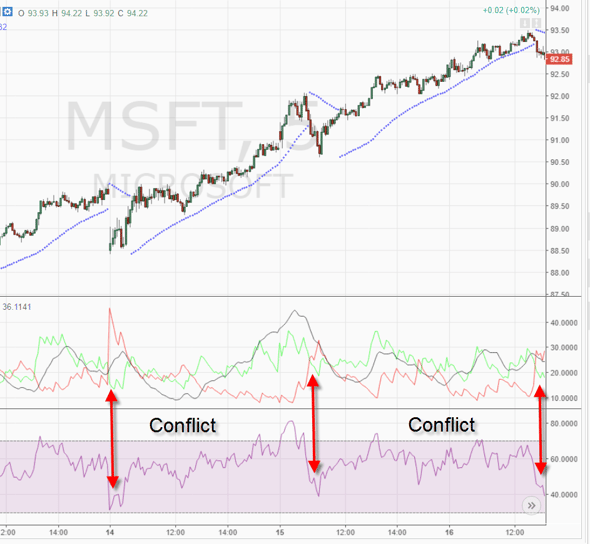

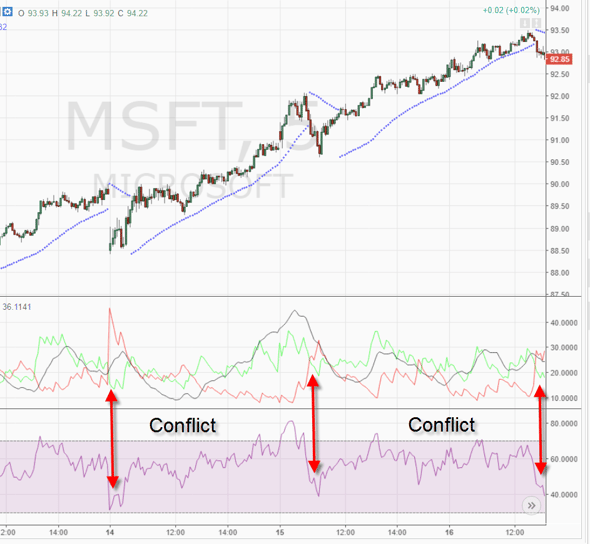

RSI – ATR – Conflict

Earlier in this article, we discussed how you can open positions as the DM lines cross one another and the ADX is at a certain threshold. Well please review the above chart.

Notice how the buying opportunity in the RSI indicator occurred when the ADX was providing a sell signal.

How do you reconcile the signals?

For me personally, it creates too much clutter on my chart and while the RSI can be used as a validation technique of the broader trend when you get down into buy/sell triggers, it could cause more confusion.

Chapter 4: ADX and Futures

Like most indicators, the ADX responds well with high volume securities that have predictable price movements. Futures by definition fit this profile to a T.

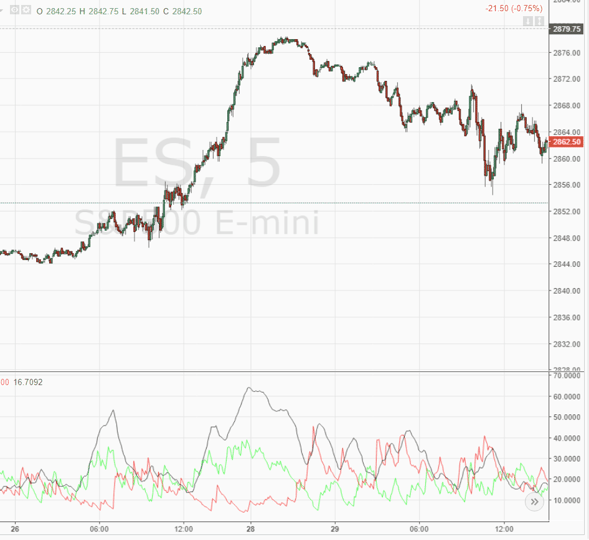

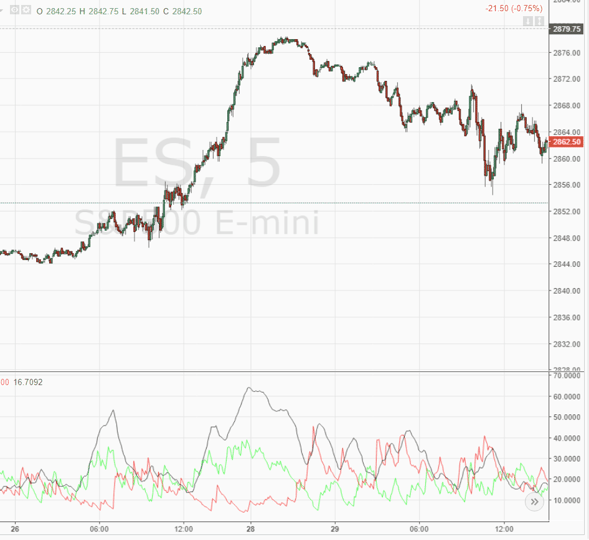

ES Mini

Above is the chart of the S&P 500 E-mini.

Before the big rally from 2,548 to near 2,580, the ADX hit a value below 20. This quiet period later resulted in this rally. This is not to say the ADX will always provide accurate signals but in the

Futures market, you can expect price movement to act accordingly and when it does not you will have time to get out of the position.

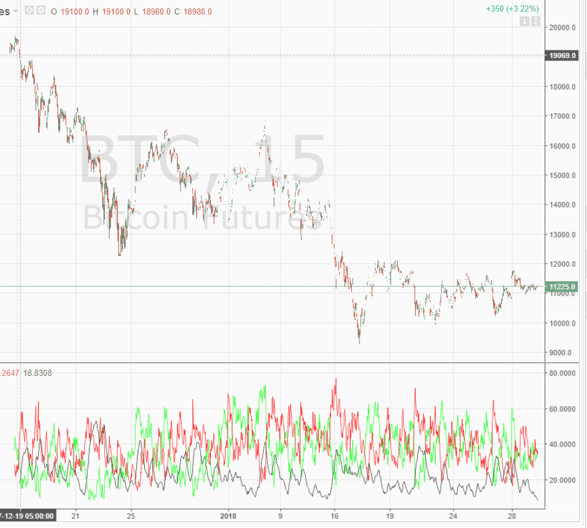

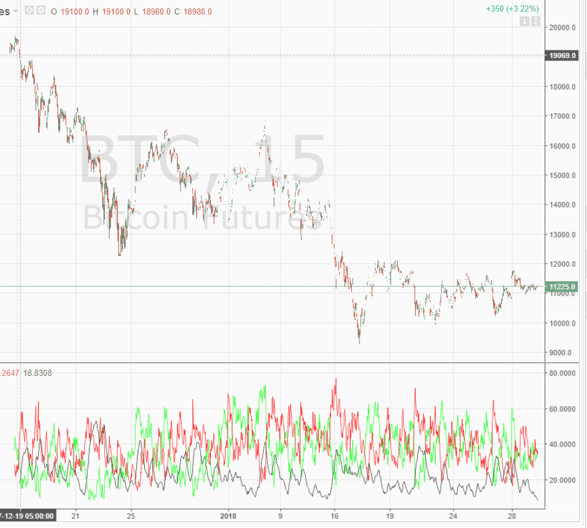

Chapter 5: Bitcoin and ADX

I looked at Bitcoin Futures trying to find some correlation between the ADX and price movements of the cryptocurrency and I could not land on anything definitive.

The minute I would see a pattern or price action at extreme ADX readings, I would then see the next ADX signal fall apart.

I largely attribute this to the volatility of Bitcoin and less to do with a failure of the indicator.

15-minute Bitcoin Chart

Late 2017 going into 2018, a 15 reading on the ADX was almost a surefire sign Bitcoin was going to break either way. Then the new number was 10 before you could expect a move. Now as we begin to move into February, 10 is producing a choppy market.

So, for these reasons, I would likely not use the ADX as a method for trading Bitcoin but would manage the risk by using smaller position sizes and common chart patterns/trend lines for entry/exit.

Guess what folks, this is ok. At times in the market, certain theories or tactics are not a good fit for either your trading style, current market conditions or your trading time frame.

In Summary

- The ADX is a valuable tool because it focuses on the trend and strength of the move

- Determine which ADX readings make the most sense for your trading style

- Avoid adding indicators to your chart that will make analysis more complicated than it needs to be

- Extremely volatile stocks will not always adhere to ADX readings

- Securities that react favorably to the ADX have high volume and reasonable volatility

Awesome Day Trading Strategies

Awesome Day Trading Strategies